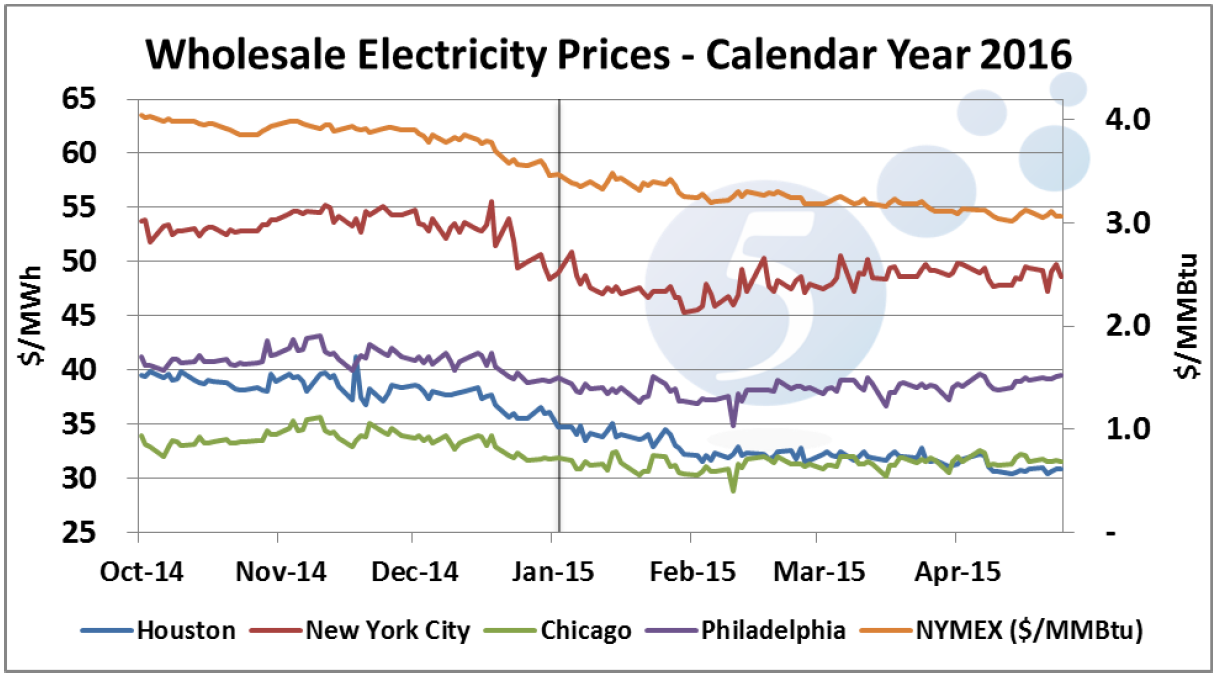

I am pleased to forward 5’s first quarter overview of the energy market. For the most part, energy markets stabilized in Q1 2015, a significant change after the collapse in oil and natural gas prices experienced in Q4 2014. The following chart shows how electricity and natural gas prices have moved during Q4 2014 and Q1 2015. While electricity prices were flat in PJM and NYISO, they continued to decline (albeit at a slower rate) in ERCOT. We also saw a continued move down in the price of NYMEX natural gas. These trends continued in April.

Before turning to the focus of this quarter’s letter, we would like to remind our clients of the unique opportunity presented by the combination of historically low prices of electricity and natural gas in both the near and long term markets. We strongly recommend that clients with open positions consider hedging a portion of such positions prior to June 1, opening day for the 2015 Atlantic hurricane season 1 and typically the start of the summer cooling season. A recent report by USGS scientists that links increased seismic activity with injection of wastewater (which is a byproduct of oil and natural gas fracking) in deep disposal wells in areas in Alabama, Arkansas, Colorado, Kansas, New Mexico, Ohio, Oklahoma, and Texas reminds us of just one of the many factors that could put upward pressure on commodity prices.

The Regulatory Arena: Significant Action Taken in Q1

Activity in the regulatory arena more than offset the relative stability of the commodity markets. In this quarter’s letter, we focus on significant legislative action in three states: New York, California and Hawaii. In each of these markets, distributed energy resources (DER) presents the biggest challenge to the traditional utility structure historically organized around large centralized power generation plants. DER is generally defined to include four key components: demand response (customers reducing load or running on site generation in response to peak pricing), distributed storage (battery storage located at customer sites), distributed generation (renewable and fossil fuel fired on site generation), and energy efficiency (customer actions that reduce consumption). All markets are struggling with how to integrate DER into an aging utility system built around centralized power plants.

Regulatory changes introduced in New York and California move utilities, in varying degrees, from being providers of integrated generation and distribution services to providers of an open access network through which energy consumers and distributed energy sources can be efficiently deployed and integrated. Hawaii’s regulators have yet to take up a fundamental restructuring of the centralized utility, but they are being forced into making similar system changes by the rapid expansion of distributed solar generation. As we noted in earlier letters, this structural market change mirrors what happened to AT&T in 1982 when it was broken up and transformed from a monopoly provider of phone service to the provider of a national trunkline that all companies (initially MCI and subsequently wireless carriers) could use to serve end use customers.2

We appear to be at a tipping point in the energy market. New technologies focused on DER are driving significant changes to the regulatory construct, and investors and developers are responding to these regulatory changes by continuing to increase the amount of capital devoted to new DER products and solutions. These products create valuable options for energy consumers; however, utilities find their historical revenue models at risk. New York is at the forefront of these changes.

New York PSC: Reforming the Energy Vision (REV)

In February 2015, the New York Public Service Commission (PSC) ordered a fundamental restructuring of the State’s energy market called Reforming the Energy Vision or REV. Driven by the potential of DER, REV “aims to reorient the electric industry and the ratemaking paradigm to a consumer-centered approach (emphasis added) that harnesses technology and markets.” The new market is driven by consumer and non-utility energy companies.

REV requires utilities to discontinue their role as integrated providers of energy. Post restructuring, utilities must maintain an open energy platform designed to “provide uniform market access to customers and DER providers.” At the center of the new model is the Distributed System Platform (DSP), an “intelligent network platform” provided by the utility. As owner of the DSP, the utility is charged with integrating DER into the market. Most importantly, the plan excludes utilities as owners of DER (emphasis added), “DER will remain a non-utility service provided by the competitive market.”3

The NY REV is not just a theoretical concept. The Commission has mandated each utility in NY file a Distributed System Implementation Plan no later than December 15, 2015.

California: Integrating Distributed Resources

Integrating distributed resources is also at the forefront of regulatory changes undertaken by the California Public Utilities Commission (PUC). California defines distributed energy resources to include distributed renewable generation, energy efficiency, energy storage, electric vehicles and demand response. In August 2014, California’s PUC issued a rulemaking that required utilities to develop distributed resources plans, and file them by July 1, 2015. In early February, 2015, the Assigned Commissioner, Michael Picker, issued a final guidance document to be used by the utilities in developing such plans.

While the underlying rationale for California’s focus on distributed resources is the role that such assets can play in meeting California’s aggressive GHG reduction targets, a parallel goal of the plan is very similar to that promoted in New York. As noted by Commissioner Picker, the plans should also reflect California’s goal:

“(1) to modernize the electric distribution system to accommodate two-way flows of energy and energy services throughout the IOU’s networks; (2) to enable customer choice of new technologies and services that reduce emissions and improve reliability in a cost efficient manner; and (3) to animate opportunities for DERs to realize benefits through the provision of grid services.”

Still, California does not seek to follow NY and totally reinvent the utility construct. The more limited focus of California’s regulatory effort is on integration of DERs into each utility’s overall planning. Key principles to be implemented in California include a “move towards an open, flexible, and node-friendly network system (rather than a centralized, linear, closed one) that enables seamless DER integration.” But even this more modest goal, “may be considered ground-breaking.”

The report notes many of the other active proceedings at the Commission that involve related areas of utility service under regulatory review. An abbreviated list, copied below, gives a good sense of the scope of change in California’s energy market:

|

|

Hawaii: What Can I Do With All This Solar?

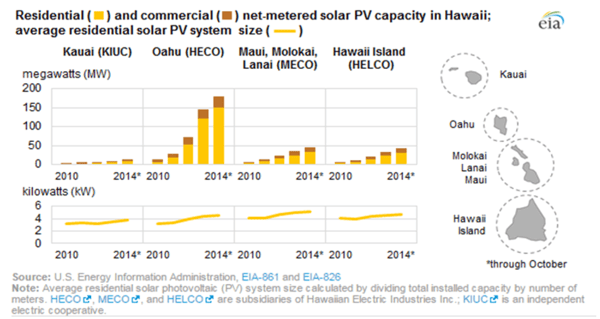

In Hawaii, the State’s Public Utilities Commission has instituted several proceedings which target issues similar to those in consideration in California and New York. Hawaii is an ideal market for distributed generation. Key factors include (i) very high retail electricity prices (ranging between 33 and 37 cents per kWh), (ii) a receptive regulatory environment, and (iii) abundant sunlight. The solar boom on the Islands is obvious. There are approximately 48,000 solar PV customers in Hawaii, roughly 12% of all customers. This compares to a US average of 0.5%. The recent growth of solar is reflected in the following chart prepared by the US EIA.

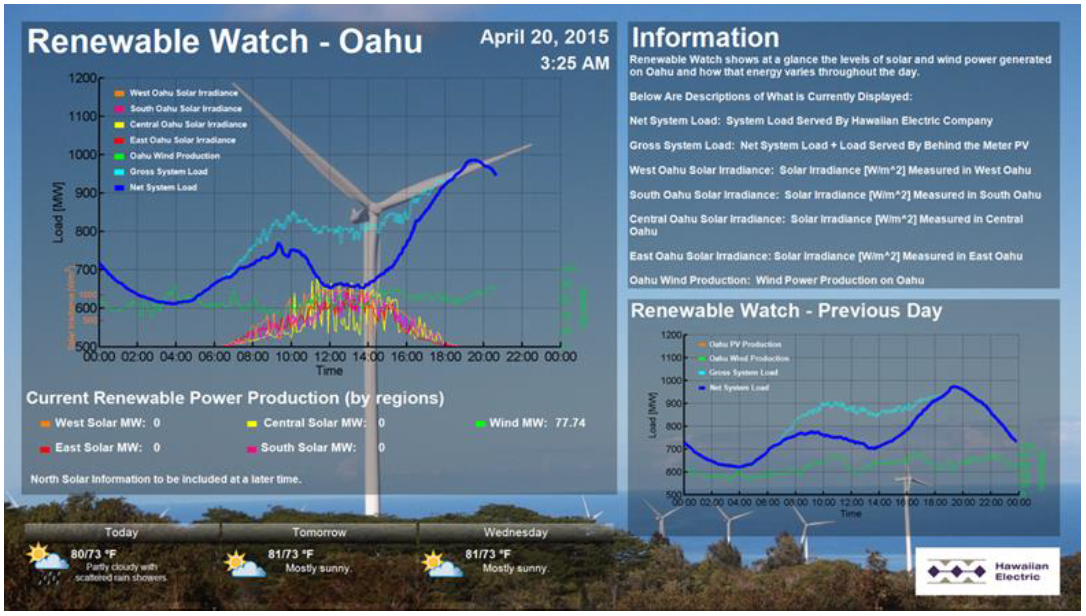

According to the Hawaiian Electric Company (HECO), solar’s growth is creating significant operational problems for the state’s electricity grid. Under current net metering rules 4 in Hawaii, when a customer’s rooftop system generates more kWh than the customer consumes (for example, at midday when the customer is not at home), the customer is credited by the utility for the retail price of power exported onto the grid. HECO argues that net metering payments are too high, and that distributed solar generation is creating technical challenges to the grid. One issue is the “duck curve” load shape shown on the blue line below.

The duck curve is formed by the net system load peaking in the morning and then dropping from 10am till around 3pm when solar reaches its peak production, and then quickly peaking again as the solar ramps down and must be replaced by utility generation. Residential PV systems are exporting so much power in the middle of the day that utilities claim they need to back down midday generation from central generation plants. Another way to think about this is that the customer gets to sell generation back to the grid at peak hours (midday), the grid stores that energy (i.e., backing down central plants), and the seller then buys it back at nighttime (when the solar plants do not generate) and electricity is less valuable (due to lower demand).

HECO responded to the rapid increase in rooftop solar by significantly slowing interconnection of new PV systems (this started in September 2013 and continued throughout 2014). The failure to interconnect new customers became a significant issue at the PUC and efforts to address the backlog are now underway.

The regulatory cloud over onsite solar has not yet lifted. HECO has proposed ending the current net metering rules and replacing them with new rules that will significantly reduce the revenue paid to owners of distributed solar for excess generation. For example, the amount paid to residential owners of a solar PV system for excess generation on Oahu (the main island) would drop from 29.5 cents per kWh to 14.7 cents per kWh. In exchange for the lower rates, HECO will “find” a way to increase the amount of onsite solar allowed on the grid. The PUC has not agreed to HECO’s proposal, and they have given HECO until June 30 to reach agreement with solar advocates.

Hawaii: The Self-Generation Option

The situation in Hawaii tracks the situation in California and New York, with one significant difference. Retail prices in Hawaii are so high and storage technology (batteries) is improving to a point at which an increasing number of consumers have an additional option - self-generation. A quick review of solar installer websites in Hawaii demonstrates the importance of the self-generation option.

As HECO pushes to drive down distributed solar payments, they create a greater incentive to move off grid. The viability of off grid solutions is closely tied to innovations in battery storage. We are closely watching the interest in off grid solutions, particularly in markets like Hawaii and California that have very high retail tariffs.

The situation in Hawaii became even more interesting in December when Florida utility giant NextEra (formerly Florida Power & Light) agreed to pay approximately $6 billion to acquire HECO. Regardless of NextEra’s underlying strategy, one thing is clear: Hawaii is an excellent market for NextEra to work through the various risks and opportunities provided by distributed generation. This is something that is likely to become an important issue for NextEra in their home market, Florida.

Federal Developments

Trends underway in New York, California and Hawaii should increase momentum at both the State and Federal level in the months ahead. On April 21, 2015, the Energy Department issued its first Quadrennial Energy Review. Not surprisingly, it focuses on “energy transmission, storage and distribution (TS&D) infrastructure….the backbone of our energy system” and the need to modernize this system to “take full advantage of American innovation and the new sources of domestic energy supply that are transforming the Nation’s energy marketplace.”

At 5, we think that we have passed a turning point on distributed energy. In every market, the challenges and opportunities provided by these new technologies must be addressed by regulators, energy suppliers and, most importantly to 5, commercial and industrial energy consumers. We look forward to working with our clients as they modify their operations to maximize the current and future value of distributed generation.