The departure of President Biden and the nomination of Vice-President Harris challenges anyone predicting the impact of the 2024 election on energy policy. Unlike President Biden or former President Trump, both of whom have clear track records on energy policy, Vice-President Harris has said almost nothing to-date about her administration’s approach to the energy market or climate change. In her speech accepting the Democratic Party’s nomination, Vice-President Harris did not use the word “energy,” and there was only a single reference to climate change – that we need “[t]he freedom to breathe clean air, and drink clean water and live free from the pollution that fuels the climate crisis.” President Trump’s stance on energy-related policies is better known, and we expect his administration will take regulatory action to help coal, natural gas and nuclear power to better compete with renewables. Notwithstanding this policy shift, our view is that a second Trump administration will not have any significant effect on near-term energy prices. Electricity and natural gas market fundamentals and the overall balance of supply and demand will likely be the main drivers of energy prices over the next six to twelve months regardless of who wins the election in November.

Recent posts by 5

2 min read

HOW THE 2024 ELECTION COULD AFFECT ENERGY POLICY AND MARKETS

By 5 on August 29, 2024

Topics: Markets Education Regulatory

6 min read

Big News in PJM's Latest Capacity Auction

By 5 on August 1, 2024

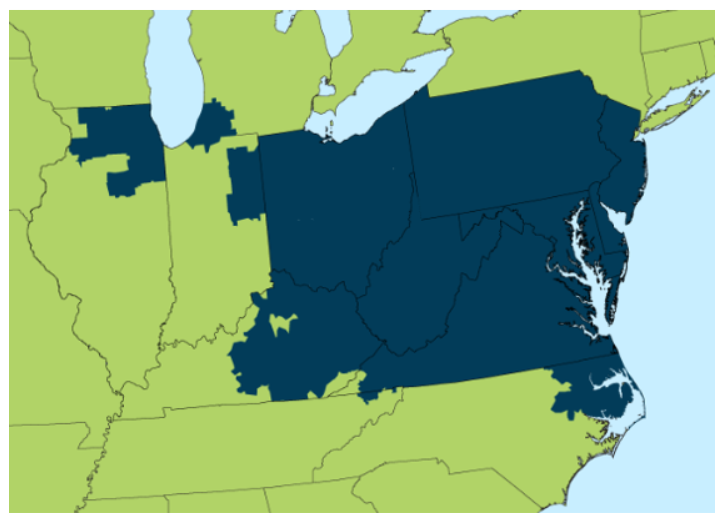

The good news is that we now know the price of capacity through May 2026. The bad news is that capacity prices have increased by approximately 5x over the last auction. The surge in price was fueled by power plant retirements, rising regional demand, and regulatory requirements seeking to address the participation of renewables and how much capacity they can provide during periods of system stress. Before examining the details of this latest auction, it’s important to review how the capacity market got to where it is today. As a refresher, the PJM Interconnection operates the largest competitive wholesale electricity market in the United States, serving 65 million people across 13 states and the District of Columbia as shown in Figure 1. Its primary function is to coordinate the flow of power and develop market rules such that the system operates reliably and safely. A critical component of PJM's operations is its capacity market, which ensures long-term reliability by securing sufficient resources to meet future electricity demand.

Topics: Markets PJM Education capacity

2 min read

Energy Industry Expert Tracy Hodge Joins 5 as Senior National Energy Advisor

By 5 on July 29, 2024

DALLAS, July 16, 2024

Industry veteran Tracy Hodge joins 5, a leading energy advisory firm in North America, as Senior National Energy Advisor.

5 is pleased to announce that industry veteran Tracy Hodge has joined the company. Tracy brings an impressive background spanning nearly two decades in the retail energy sector to her new role at 5. Prior to joining 5, Tracy managed the Interactive Energy Group (IEG) brokerage business, where she drove significant growth and innovation. IEG is a wholly owned subsidiary of Just Energy. She also held key roles at Ambit Energy and Save On Energy, developing strategic partnerships and leading product marketing initiatives that substantially enhanced customer experiences and business profitability.

Topics: ERCOT Procurement Press

1 min read

Webinar Recording: NEW YORK TIER 1 REC SALES - July 10, 2024

By 5 on July 11, 2024

Topics: Markets Clients Videos Education Regulatory

4 min read

Electricity Market Update

By 5 on June 26, 2024

ERCOT

There are two words that describe the reaction of most commercial clients shopping for electricity in Texas: Sticker Shock. Figure 1 shows how the wholesale price of electricity for calendar years 2025 through 2028 has traded over the last four years. In ERCOT, electricity markets were at all-time lows of approximately $20/MWh in the months immediately before the pandemic. Over the last 48 months, power prices in ERCOT have more than doubled as wholesale prices are now more than $50/MWh for calendar years 2025 through 2028. The steady rise of electricity prices in ERCOT is largely driven by concerns that there is not enough supply to meet growing demand across the state. This demand is coming from power-hungry data centers used to support the rapid growth in AI, technology, and cryptocurrency mining in addition to manufacturing and population growth throughout the state. While substantial amounts of electricity from new solar and wind-generating assets have come online, those intermittent resources cannot be counted on to operate on demand. These are some of the dominant factors that have pushed up wholesale electricity prices in ERCOT.

Topics: PJM NYISO ERCOT Procurement

6 min read

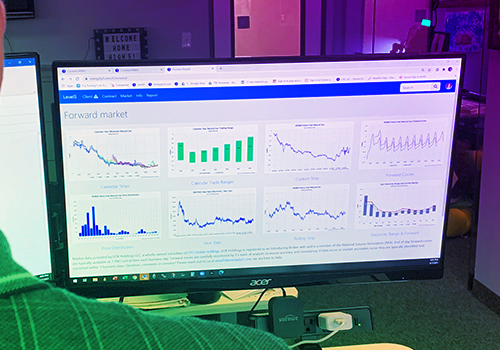

Level5: A Game Changing Energy Management platform

By 5 on June 26, 2024

W. Edwards Deming, the father of Total Quality Management, famously stated,"Without data, you're just another person with an opinion." Deming was instrumental in using data and statistical process controls to make better business decisions. When it comes to energy markets, there is a data deficiency and a lack of price transparency for most clients. Without adequate energy market data, many energy-related decisions are made on speculation, inadequate or inaccurate information that can lead to actions taken on biases and false assumptions.Level5 is a proprietary platform built entirely in-house by 5’s industry-leading development team. For clients, it serves as a data repository, usage analysis tool, and supercharged market analysis engine. Since 5 is a data-driven company, Level5 forms the foundation of our energy advice and is at the core of our customized energy strategies. 5 firmly believes that better energy decisions are formed from better energy data.

Topics: Sustainability Education Renewables

3 min read

How Hurricanes Affect Energy Prices

By 5 on June 26, 2024

Hurricane season officially began this month and in a report at the end of May, NOAA predicted between 17 and 25 named storms for the period between June 1 and November 30. According to NOAA, “The upcoming Atlantic hurricane season is expected to have above-normal activity due to a confluence of factors, including near-record warm ocean temperatures in the Atlantic Ocean, development of La Nina conditions in the Pacific, reduced Atlantic trade winds and less wind shear, all of which tend to favor tropical storm formation.” It is only three weeks into hurricane season and Tropical Storm Alberto has already pounded Mexico and parts of Texas with torrential rain and flooding. Many clients ask how hurricane and tropical storm activity affect energy prices. In the past, significant hurricane activity in the Gulf of Mexico had a major impact on natural gas prices. In the 1990’s, hurricane tracking was one of the most important fundamentals energy traders watched. The destructive capabilities of a powerful hurricane in the Gulf of Mexico heading towards the large production regions (Corpus Christi TX to Mobile AL) would cause drilling and production platforms in the Gulf to evacuate their personnel, typically requiring the well to be closed. This would result in a dramatic reduction in the amount of natural gas produced for a week or more if there was substantial damage to the platforms. As shown in Figure 1, the highest natural gas prices in the last thirty years occurred in the wake of Hurricanes Rita and Katrina in 2005. Both storms caused major disruptions to the production and flow of natural gas.

Topics: Markets Natural Gas

5 min read

Understanding RECs in New York 2024

By 5 on June 20, 2024

New York, like many states across the country, has a standard by which certain qualifying renewable generation assets are awarded one Renewable Energy Certificate (REC) for each MWh of electricity delivered to the grid. RECs provide two main functions to the market: