What Caused the Most Recent PJM Capacity Auction Delay?

On December 22, 2021, the Federal Energy Regulatory Commission (FERC) ordered PJM to change its reserve market rules. This move, yet again, delays the 2023/2024 capacity auction, previously set to occur on January 25, 2022.

In May 2020, FERC largely approved a proposal from PJM to overhaul their operating reserve market that was projected to cost ratepayers an additional $500 million to $2 billion annually. Operating reserves represent emergency backup generation kept on the system in case there is an unexpected outage or sudden increase in demand. PJM procures these reserves from generators based on how much-projected capacity is needed at any specific time. The proposal outlined PJM’s plan to consolidate tier one and tier two reserve products and to adjust the height and shape of PJM’s operating reserves demand curves (ORDC), thus increasing the amount of reserve generating capacity required on the grid, increasing the cost to ratepayers.

In last month’s decision, FERC reversed its approval of the ORDC changes, stating that “PJM failed to show how its ‘reserve penalty factors’ and two-step ORDCs that had been in place before the commission approved changes last year were unjust and unreasonable.” Critics pointed out that FERC’s initial approval of the May 2020 proposal was not a thorough assessment of whether PJM’s market revisions were in the best interests of consumers.

Additionally, FERC reversed its original approval and is now requiring PJM to base energy and ancillary service (E&AS) revenue offsets on historic prices as opposed to the original proposal which shifted to forward-looking methods. E&AS offsets are designed to reduce capacity market revenue to match the gains generators receive via reserve markets.

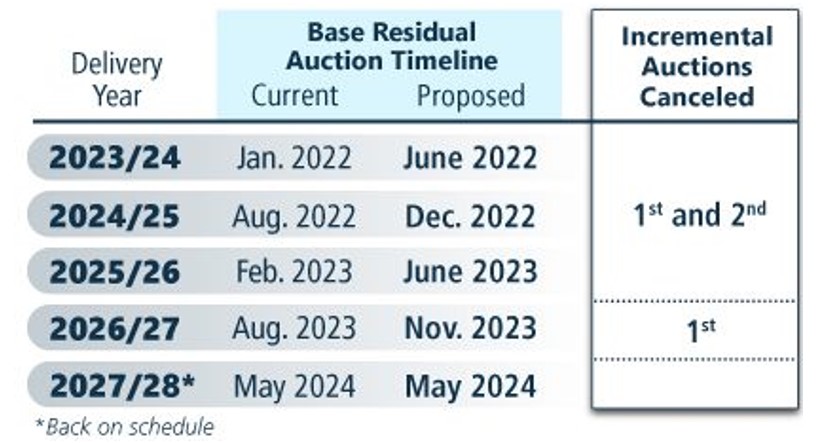

FERC granted PJM 60 days to revise its proposal. On Monday, January 24, 2022, PJM released its revised schedule for upcoming capacity auctions. The revised auction schedule is shown in Figure 1.

Figure 1: PJM Revised Auction Schedule from insidelines.pjm.com

PJM capacity auctions are typically held three years in advance of the delivery year. The 2022/2023 auction was originally scheduled for May 2019, but it was postponed until 2021 while FERC evaluated PJM’s proposed capacity market rules, specifically the Minimum Offer Price Rule (MOPR).

The capacity auction delays in PJM affect customers by prolonging the uncertainty in capacity costs beyond May 2023, along with increased risk premiums required to mitigate the risks associated with this lack of transparency. This risk manifests itself in the form of higher capacity costs included in fully fixed-price electricity offers from retail suppliers.