There has been a lot of news lately regarding capacity throughout PJM. As we have reported in the past, the Federal Energy Regulatory Commission (FERC) and PJM have been at odds over the mechanism by which the price for capacity is set. In December, the FERC issued a ruling that prescribed new rules and requirements around the auctions that establish capacity prices. Before getting into those details, we wanted to offer a quick review of what capacity is and why this issue is important.

What is Capacity?

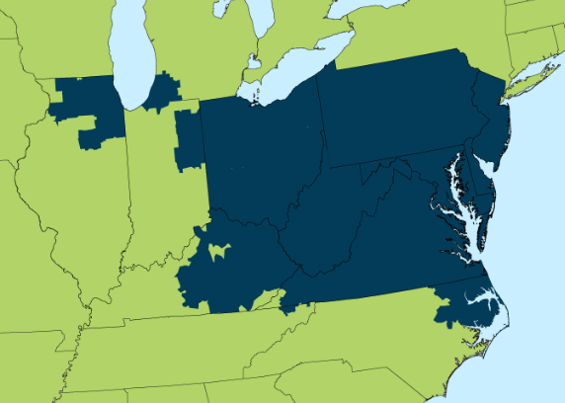

The PJM Interconnection (PJM) is an independent entity that is responsible for ensuring that there is enough electricity supply to meet the demand that is placed on the electricity grid. PJM manages the electricity grid in the areas shown in blue in Figure 1. On hot summer and cold winter days when demand is high, PJM calls upon electricity generators that are on stand-by to begin producing the electricity that is needed to keep up with demand. A commitment by an electricity generator to provide energy when it is needed for a specific period of time is called capacity. The price for capacity in PJM is set through a competitive auction process.

In many ways, capacity is like an insurance payment that is paid in advance to ensure that electricity supply and demand are in balance. When a fixed price for electricity is offered to a client from either the utility or an Energy Supply Company (ESCO), the cost of capacity is a component of that fixed price. Approximately 20-40% of a client’s fixed price for electricity is related to the cost of capacity, which is highly dependent on the specific utility territory. For example, the cost of capacity is much higher in PSE&G (NJ) than in BG&E (MD). In the case of a client who pays 10 ¢/kWh for electricity, between 2.0 to 4.0 ¢/kWh of that cost is related to capacity payments that the utility or the ESCO must make to PJM.

Figure 1: Map of PJM, by pjm.com

Figure 1: Map of PJM, by pjm.com

What is Happening With Capacity?

Many states are adopting and implementing plans to increase the amount of electricity generated from non-fossil fuel sources such as wind and solar. Additionally, nuclear power plants have become an important component in each state’s electricity generating portfolio since they do not emit greenhouse gases. Since the price of natural gas has fallen dramatically in the last few years, electricity from wind, solar and nuclear sources have become less competitive in deregulated electricity markets. Falling gas prices have prompted some states to implement subsidies to support the development of renewable electricity and to keep their nuclear power plants in operation. Without these subsidies, many of these plants would not be able to compete with low-cost electricity from natural gas generators. For example, states such as New Jersey and Illinois have included a subsidy to all nuclear power plants called Zero Emission Credits (ZECs). This subsidy is included in every electricity customer’s bill to support the nuclear power plants in those states. The issue is that these subsidies from specific states come into conflict with competitive market rules that govern the way electricity and capacity prices are established across PJM’s interstate territory.

For a competitive market to work efficiently, the capacity prices, in concert with the wholesale energy prices, paid to generators should reflect the cost of building and operating the market’s power plants. Government subsidies to promote renewable or carbon-free electricity provide renewable and nuclear plants with a competitive advantage over fossil fuel plants. These subsidies allow plants to bid into PJM’s capacity auctions at a price that is not directly related to their true, underlying costs. The larger the subsidy, the more a subsidized generator can lower its bid into the capacity auction, displacing more efficient and lower-cost power plants. It will be difficult for many deregulated markets to establish bidding rules that incorporate different renewable mandates from different states. This is why the FERC stepped in to challenge the way PJM was establishing the price of capacity. In December, the FERC issued a ruling that required PJM to change the way the price of capacity is established. Details on FERC’s recent ruling can be found here.