Consequences of Increased State Regulations of Wholesale Energy

State Renewable Portfolio Standards and other renewable power regulations increase the cost of electricity and creates budget uncertainty. Large energy users need to follow multiple state regulations to estimate future energy costs. At 5, we are spending more and more time advising clients on state regulations as well as new local regulations that address carbon emissions. New York City just adopted building regulations that require all buildings over 25,000 square feet to reduce emissions by 40% by 2030 and by 80% by 2050. Buildings that are unable to meet emissions targets will be subject to significant fines. It will be interesting to see if other local jurisdictions follow New York City and pass regulations to address carbon usage.

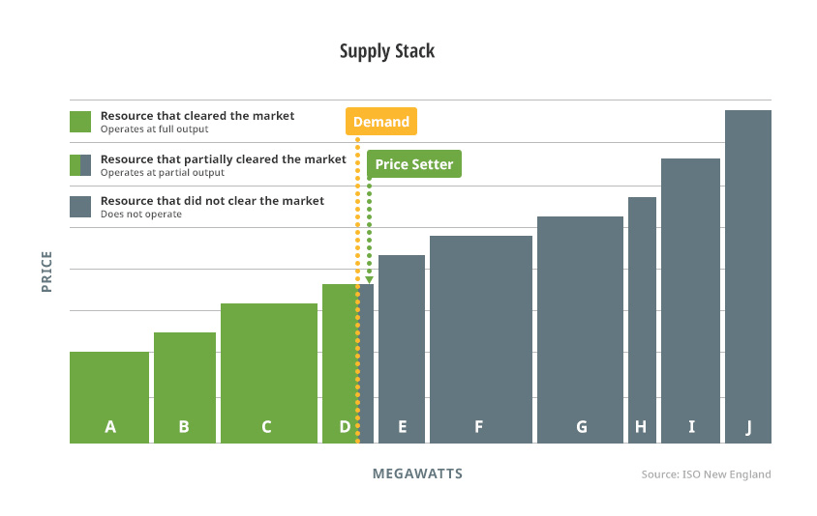

State regulators often pass renewable electricity mandates without adequately considering how such regulations impact wholesale energy prices. In deregulated markets, the energy price is set through a competitive process. Market operators, Regional Transmission Organizations (RTO), run auctions to set the price of electricity. In each of these markets, generators submit the price at which they are willing to sell power into the market, and the RTO selects generators based on lowest price – without considering fuel type.[1] The diagram below shows a sample supply stack.

Figure 1: Supply Stack from ISO New England

Figure 1: Supply Stack from ISO New England

For a competitive market to work efficiently, the price paid to a generator should reflect the cost of building and operating a power plant. Government subsidies to promote renewable or carbon free (e.g. nuclear power) electricity provide renewable and nuclear plants with a competitive advantage over fossil fuel plants. These subsidies allow plants to submit bids at a price that is not directly related to their cost of producing electricity. The larger the subsidy, the more a subsidized generating plant can lower its price, displacing more efficient and lower cost power plants. Since decisions to invest capital in existing or to-be-developed generation plants are based on basic forces of market supply and demand, when the market structure no longer rewards the low-cost generator, developers are no longer incentivized to find ways to lower the cost of electricity.

It will be difficult for many deregulated markets to establish bidding rules that incorporate so many different renewable mandates that have been adopted by many states. As the map below demonstrates, PJM is a single energy market and RTO that comprises 13 states, the District of Columbia and includes 21 different utility companies.

How can PJM or any other RTO develop common rules for all market participants, if each state sets its own renewable or carbon emission standards? At a recent PJM meeting, Stu Bessler, who oversees market operations for PJM, acknowledged that it would be difficult to set up market rules if only some states set carbon emission targets.

Figure 2: Map of the PJM Interconnection from ferc.gov

Figure 2: Map of the PJM Interconnection from ferc.gov

The team at 5 has lived through multiple periods of market disruption. In almost every case, regulatory change and uncertainty results in unforeseen circumstances. On a macro level, our supply desk has been warning for some time about disproportionate amounts of renewable generation that is being developed across all markets. In light of these trends, we encourage our clients to continue to actively manage their exposure to energy market volatility.

[1] In regulated markets the price of power is based on the cost of generation and state decisions to support carbon free or renewable power simply increases the cost of power.