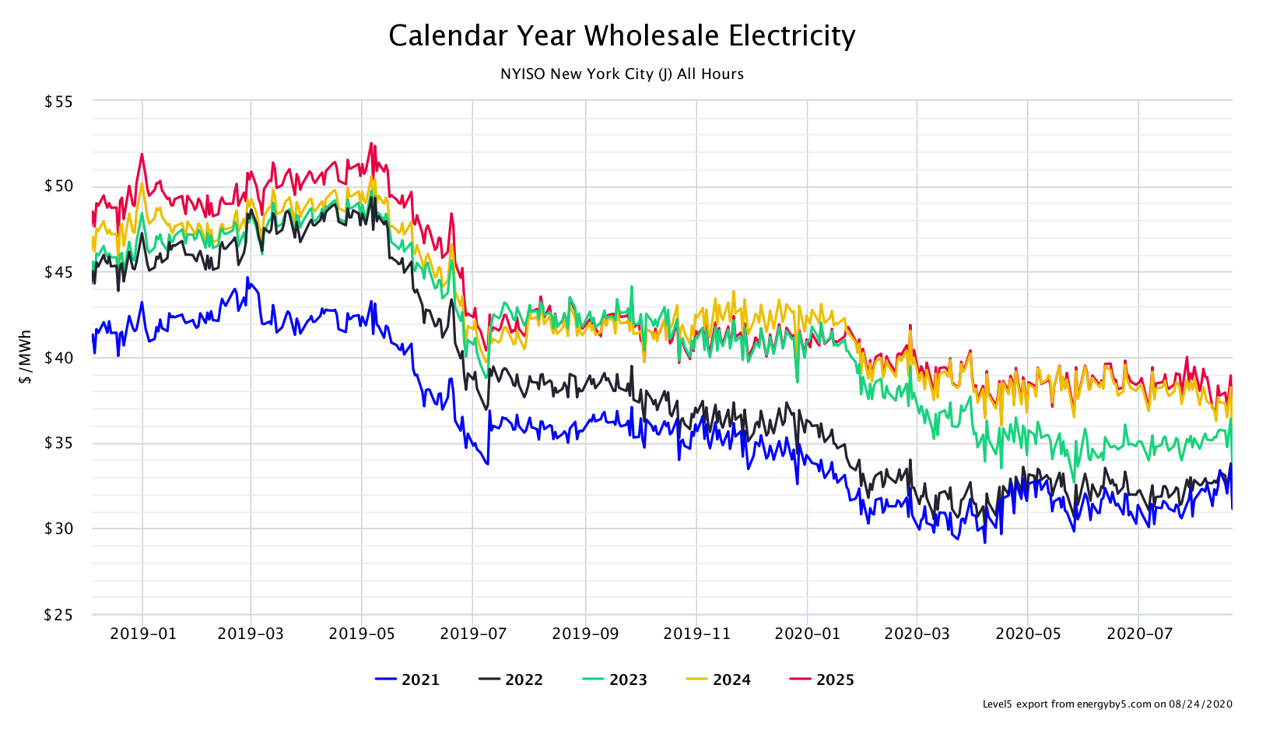

Over the last month, near-term electricity prices in New York have risen while longer-term prices have fallen. Figure 1 shows how the price of a one-year strip of electricity has traded since January 2019 for calendar years 2021 through 2025 in New York City. Note how prices in the near-term, 2021 (blue line) and 2022 (black line), have been rising over the last several weeks after hitting lows earlier this year in April and July. Longer term prices for calendar years 2024 (yellow line) and 2025 (red line) have been falling since the middle of July. It is important to note, however, that despite these recent market movements, overall prices across all calendar years are trading at or near their 4-year lows.

Figure 1: Calendar Year Wholesale Electricity, from 5

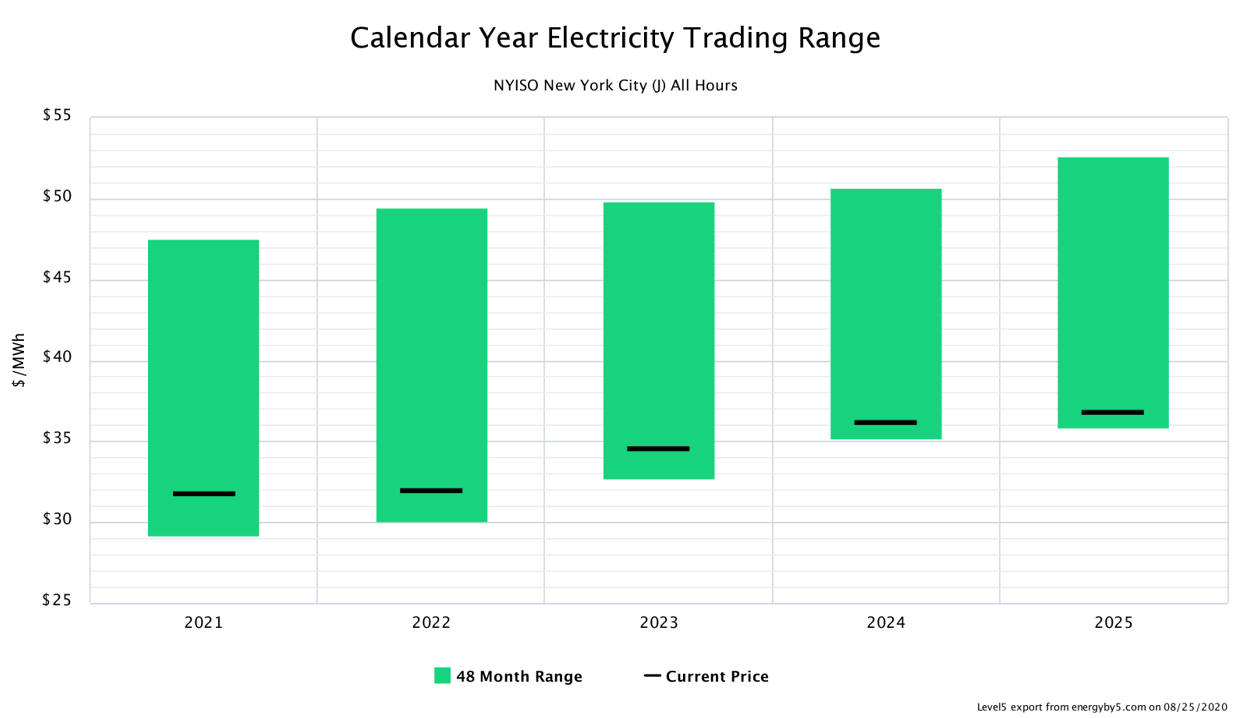

Figure 2 shows the 48-month forward trading range for wholesale electricity in New York City. The height of the green bar shows the range of low and high prices for electricity in calendar years 2021-2025. The black bar shows where electricity was trading on 8/24/20. This chart clearly shows that prices for all calendar years are at the bottom of their 4-year trading range. There is a slight premium as prices get more expensive in each successive year, but it is not significant as prices for calendar year 2021 are trading at $31.19/MWh and 2025 is trading at $35.82/MWh. It is a good purchasing signal when the price of any commodity is at or close to the bottom of its historical trading range.

Figure 2: Calendar Year Electricity Trading Range, from 5

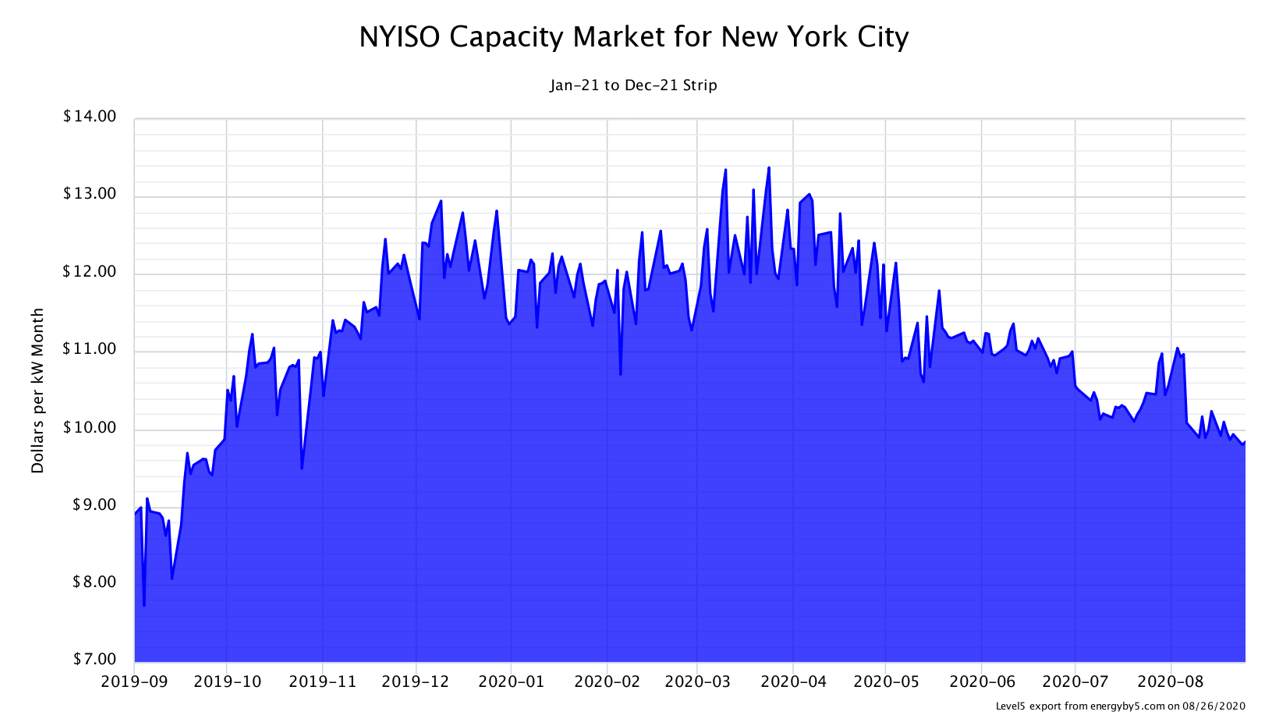

In New York City, the forward price of capacity has fallen throughout the summer. Figure 3 shows how 2021’s capacity price has traded over the past 12 months. Last fall, forward capacity prices rallied, eventually peaking during the winter, and then began slowly falling since April, giving up most of the previous gains. Relatively low energy prices and falling capacity prices might lead some to believe that now is a good time to make fixed price electricity purchases. And that is partially true.

Figure 3: NYISO Capacity Market for New York City, from 5

There is little question that energy prices are in an attractive place to make a purchase as the market data shows in Figures 1 and 2. However, fixed price electricity products are comprised of the cost of the energy and the cost of capacity, in addition to several other components. In New York, retail electricity suppliers value a client’s capacity by determining the amount of electricity that client draws from the electricity grid on the highest demand day of the year. For most businesses, that peak demand value, usually set in July or August, may not be typical because electricity usage and demand have both been dramatically affected by the coronavirus.

A retail electricity supplier looking at a business’ historic electricity usage to generate a fixed price offer will see anomalous data over the last six months that is not representative of its ordinary operations. The uncertainty in a client’s future electricity usage forces a retail supplier to add risk premiums to its fixed price offer. A better approach is to consider product structures that fix the energy while treating capacity in a way that avoids excessive risk premiums. Some of these alternative product strategies are discussed in "How Not to Buy in PJM and NYISO".

Now, more than ever, clients in New York need to work with a knowledgeable energy advisory firm. The right approach to risk management can make or break bottom-line expenses during this time of uncertainty. We are here to help.