The biggest story in Texas’ energy markets has been the collapse of West Texas Intermediate (WTI) crude oil prices. The price for the WTI May contract had its largest single-day decrease on Monday, April 20th. It was also the first time in history that the price of crude was negative and closed below zero at the end of the trading day. There was a slight recovery the following day as the price rose above zero and settled at $10.01 per barrel on Tuesday. In addition to having a massive impact on Texas’ economy, this unprecedented drop in the price of WTI crude is also having a significant impact on natural gas prices.

One might expect that natural gas prices would follow the price of crude and approach all-time lows. However, the massive sell-off in oil prices and the decrease in production that is likely to follow means that less natural gas will be extracted from the Permian Basin as a by-product of crude oil production. Near-term gas prices have not materially changed because most believe the economic slow-down and reduced demand for gas will persist for the next several months. However, gas prices have dramatically increased starting in Q3 2020 and continuing into 2022.

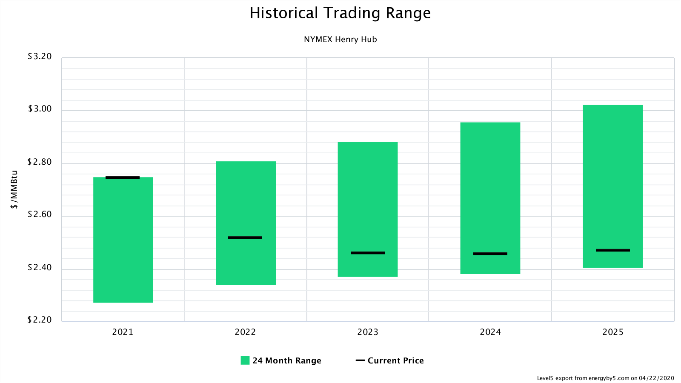

Figure 1 shows the 24-month forward wholesale trading range for natural gas. The height of the green bar shows the range of low and high prices for natural gas in calendar years 2021-2025. The black bar shows where gas was trading on April 22nd. This chart shows that prices for the calendar year 2021 closed at its 2-year high. This, in turn, is having an impact on future power prices in Texas. Read more about how natural gas prices are reacting to the decline in crude oil prices here.

Figure 1: Historical Trading Range NYMEX Henry Hub, by 5

Figure 1: Historical Trading Range NYMEX Henry Hub, by 5

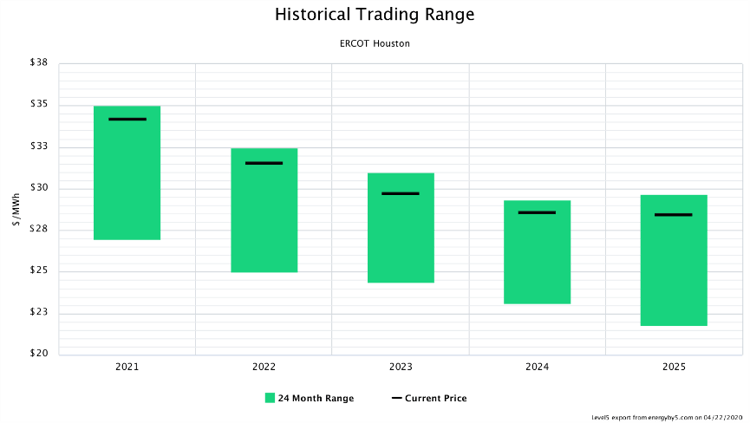

When natural gas prices rise in Texas, it is the tide that lifts all ships. Any other market news that might exert bearish forces to lower power prices is having a difficult time fighting against the rally in natural gas prices. Over the last several weeks, the wholesale price of electricity in Texas has pushed its way toward its 2-year highs. Figure 2 is similar to the gas chart above and shows the 24-month trading range of wholesale electricity in Houston. The black line in this chart shows that this week, electricity prices were near the top of its trading range for all calendar years out to 2025.

Figure 2: Historical Trading Range ERCOT Houston, by 5

Figure 2: Historical Trading Range ERCOT Houston, by 5

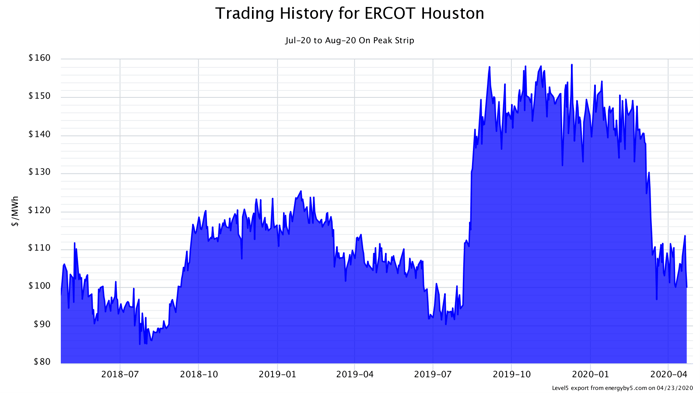

The good news for Texas electricity customers is that this summer’s power prices remain very attractive. The economic slow-down, anticipated decrease in demand, and potential increase of reserve margins have kept power prices low for this summer. Figure 3 shows how on-peak electricity prices for the summer of 2020 have traded in North Texas over the last two years. This chart shows that the average price for this summer’s on-peak power has traded between $140 and $150 per MWh since last August’s spot price volatility. Those prices have fallen to $100 per MWh, a drop of about 33% over the last six weeks. Electricity users who have not yet secured their price for this summer should act now and before warmer temperatures arrive and begin to unsettle the market.

Figure 3: Trading History for ERCOT Houston, by 5

Figure 3: Trading History for ERCOT Houston, by 5

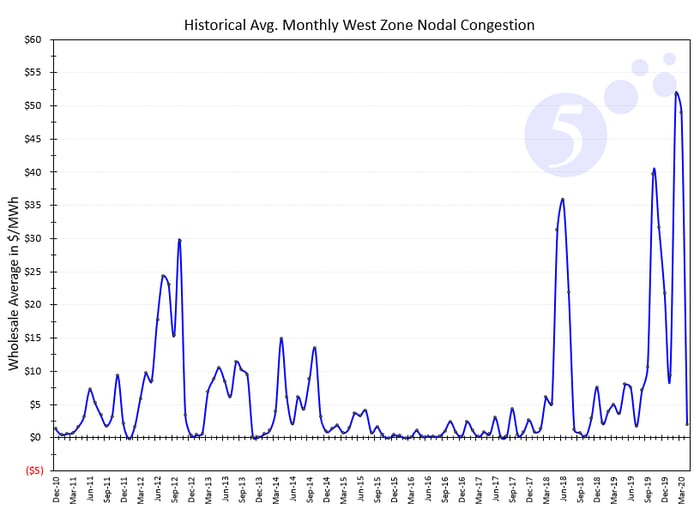

West Texas congestion also seemed to settle down over the last month. Six months ago, West Texas Hub to Load Zone congestion pricing dramatically increased and reached an average of approximately $50 per MWh in February and March 2020. So far, this month, it has averaged $2.00 per MWh, which is in line with congestion pricing in the other 3 zones in Texas. While it is very difficult to identify one specific driver behind the decrease in congestion pricing, it happened to coincide with the dramatic fall in WTI crude oil prices. Regardless of the cause, this has been a relief to electricity buyers in West Texas.

Figure 4: Historical Avg. Monthly West Zone Nodal Congestion, by 5

Figure 4: Historical Avg. Monthly West Zone Nodal Congestion, by 5

Finally, on the regulatory front, on March 24th the Public Utility Commission of Texas (PUCT) approved the COVID-19 Electricity Relief Program, which authorized a customer assistance program for certain residential customers. There was a fear among regulators that a wave of unpaid electricity invoices caused by the historic surge in unemployment could bankrupt some Retail Electricity Providers (REPs) and disrupt ERCOTs market operations in the deregulated parts of the state. This relief program prohibits REPs from disconnecting the electricity service of eligible residential customers because of an inability to pay their bills. The program will be funded with a new monthly tariff rider that will be assessed by the local Transmission and Distribution Utility (TDU). This rider will be set at $0.33 per MWh ($0.00033 per kWh) and used to reimburse REPs for unpaid bills from those eligible residential customers.