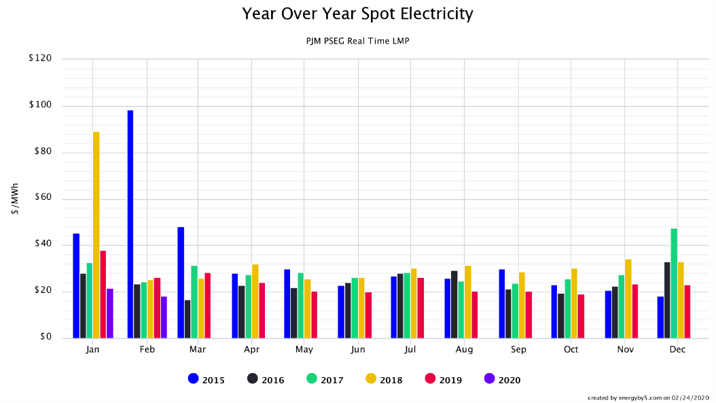

In New Jersey, similar to neighboring states, larger electricity users (with a peak demand of over 500 kW) are classified as Commercial Industrial Energy Price (CIEP) customers. For these customers, the default utility price is an hourly rate that is an average of hourly prices over the course of a given month. Since these prices change every 15 minutes, there can be a tremendous amount of price risk and volatility with this structure. However, over the last five years, there has not been a significant amount of hourly price volatility. Figure 1 shows the average monthly real-time (hourly) price in the Public Service Enterprise Group (PSEG) zone for each month of the year beginning in January 2015. In New Jersey, and throughout the Northeast, the most volatile times of the year are the winter months of December through March. This is reflected in the chart below with price spikes in January 2018, February 2015, March 2015 and December 2017. It is interesting to note that hourly prices for this winter’s months of January and February are at their five-year lows.

Figure 1: Year Over Year Spot Electricity, by 5

Figure 1: Year Over Year Spot Electricity, by 5

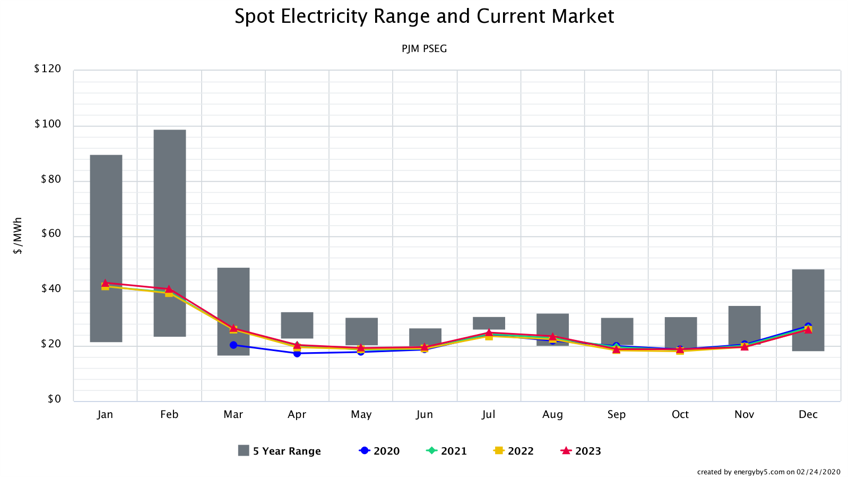

The lack of significant price volatility in PSEG and other PJM markets has created good purchasing opportunities by driving down forward risk premiums. Figure 2 compares forward prices for each month in 2020, 2021, 2022 and 2023 with the five-year historical range for those same months. Note that outside of the winter months, futures prices are trading at a discount to the historical five-year range. And even for the months of December through March, the forwards are trading toward the bottom of that historical trading range. This suggests that the premiums for forwards purchases are not significant. These are strong purchasing signals.

Figure 2: Spot Electricity Range and Current Market, by 5

Figure 2: Spot Electricity Range and Current Market, by 5

Good electricity purchasing strategies are determined by comparing risk and reward as opposed to attempting to “time the market” and only make purchases at the bottom. In examining price trends in New Jersey and specifically in PSEG as shown in Figures 1 and 2, there seems to be more upside risk than downside potential. A prudent strategy for CIEP clients in these market conditions would be one that capitalizes on the bearish market trends and attractive forward prices.