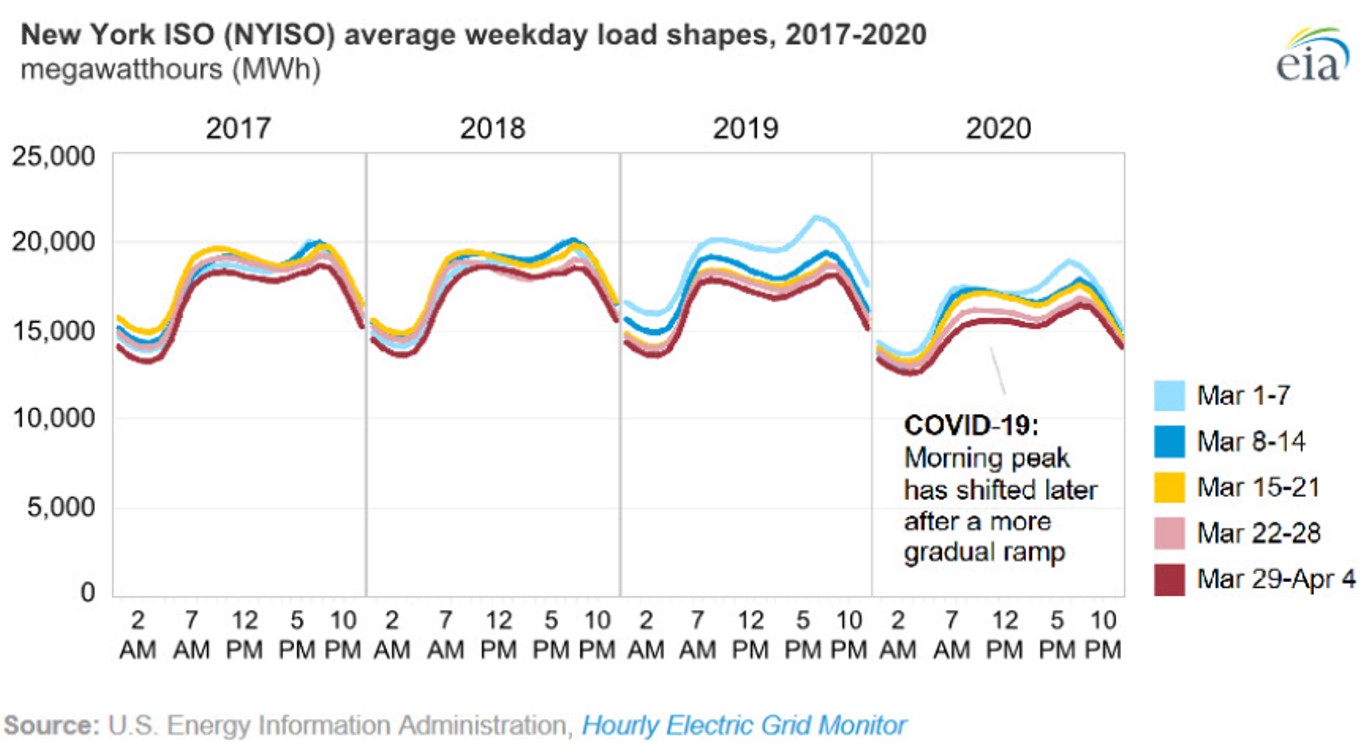

Every four years, the New York Independent System Operator (NYISO) commissions a study to evaluate and forecast the balance of electricity supply and demand in the state. This study considers the economy, demographics, implementation of energy efficiency measures and many other factors used to assess the amount of electricity needed across the state. This latest study examined the period from May 2021 to April 2025, in an attempt to determine the amount of electricity supply that is needed to keep up with expected changes in demand. Notably, the economic effects and the demand destruction in New York State and New York City caused by the COVID-19 pandemic are built in to this study. This is a critical point because there was a 13% reduction in electricity consumption in NYC during the first wave of this pandemic in March-April 2020[1]. This change in electricity demand, driven mainly by the pandemic is shown below in Figure 1. This recently released study from the NYISO predicts that there will be less demand for electricity supply in the state of New York, which resets and lowers the demand curve that is used to establish the price for capacity. This is important for electricity buyers because it will likely lower the future cost of capacity.

Figure 1: NYISO Average Weekday Load Shapes, 2017-2020 from eia.gov

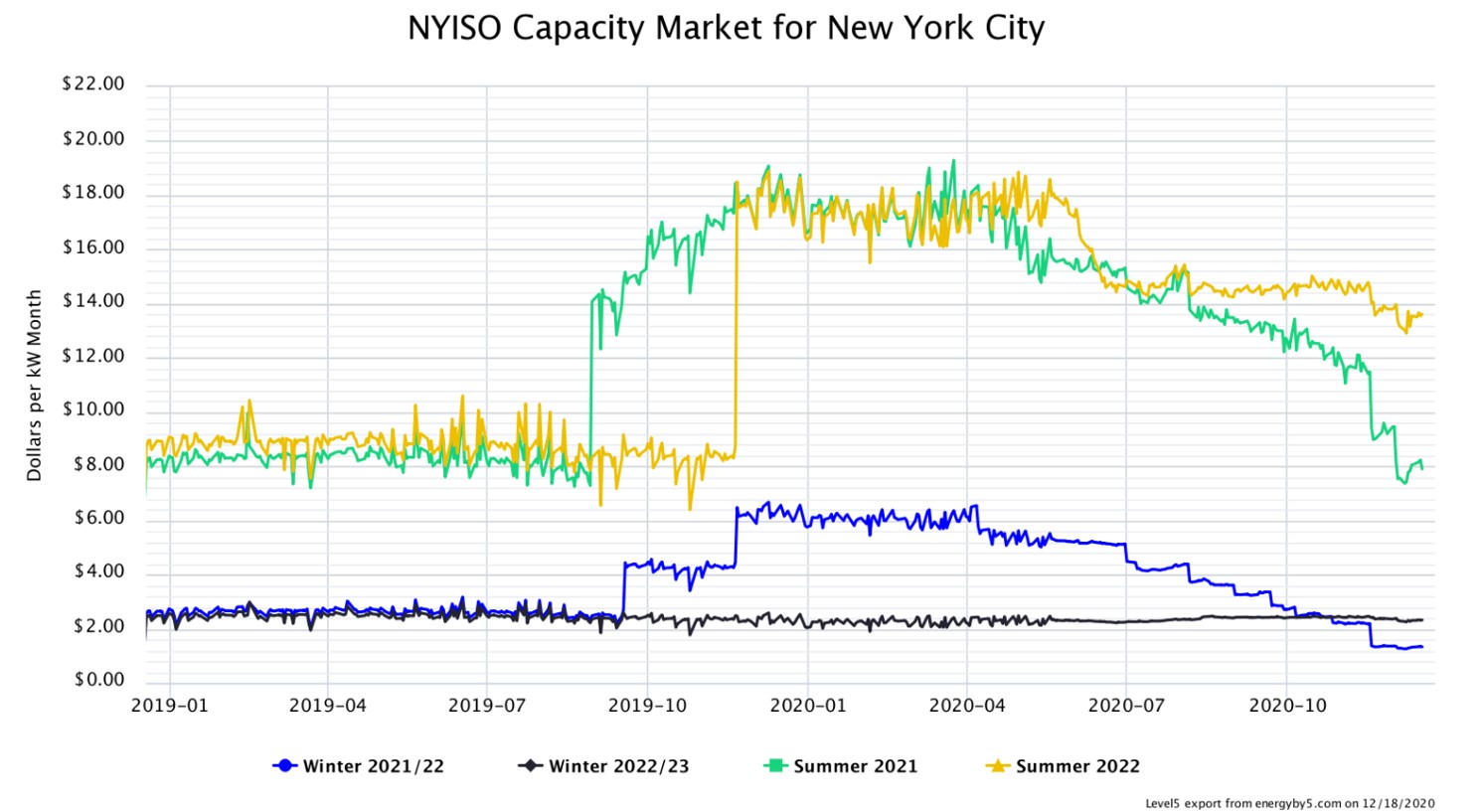

Capacity is a component of every retail electricity price and reflects payments that are made to electricity generators to ensure that those generating units run during periods of peak electricity demand. Capacity is similar to an insurance payment made in advance that maintains the proper balance between electricity supply and demand. When a fixed price for electricity is offered to a client from either the utility or an Energy Supply Company (ESCO), the cost of capacity is a component of that fixed price. Approximately 20-40% of a client’s fixed price for electricity is related to the cost of capacity, which is highly dependent on the specific utility territory. For example, the cost of capacity is much higher in New York City than in Buffalo. In New York City, capacity can be as much as 40% of a retail electricity price. In the case of a downstate client that pays 10 ¢/kWh for electricity, between 3.0 to 4.0 ¢/kWh of that cost is related to capacity payments that the utility or the ESCO must make to the NYISO. Additionally, there is a market price for capacity that varies by season (winter/summer) and geographic region.

Figure 2 shows how the forward price of capacity in New York City has varied, by season, over the last two years. Note that there is a significant difference between summer and winter capacity prices and it is often the summer capacity price that is a main driver of retail electricity prices. The sharp increase in capacity prices for the summers of 2021 and 2022 is the reason why some electricity clients in New York City may have seen higher prices on their retail electricity contracts. This chart also shows how the price of summer and winter capacity has decreased in the wake of the COVID-19 pandemic. These falling capacity futures shows that the market expects the negative economic consequences of the pandemic to linger well into next winter.

Figure 2: NYISO Capacity Market for New York City from 5

These falling capacity futures offer an opportunity for electricity buyers in New York to lower their electricity costs through properly structured products. The recent demand curve revision, falling capacity futures and demand destruction in New York are among the reasons why clients should consider purchasing options other than a fixed price. Electricity clients that are on an electricity product that passes through capacity charges will likely lower their costs over the next few years. This is a perfect example of why it makes sense to leave certain electricity cost components open as opposed to only considering fixed price electricity contracts. Now, more than ever, clients in New York need to work with a knowledgeable energy advisory firm. The right approach to risk management can make or break bottom-line expenses during this time of uncertainty. We are here to help.

[1] https://ajot.com/news/daily-electricity-demand-in-new-york-falls-about-13-after-covid-19-mitigation-efforts