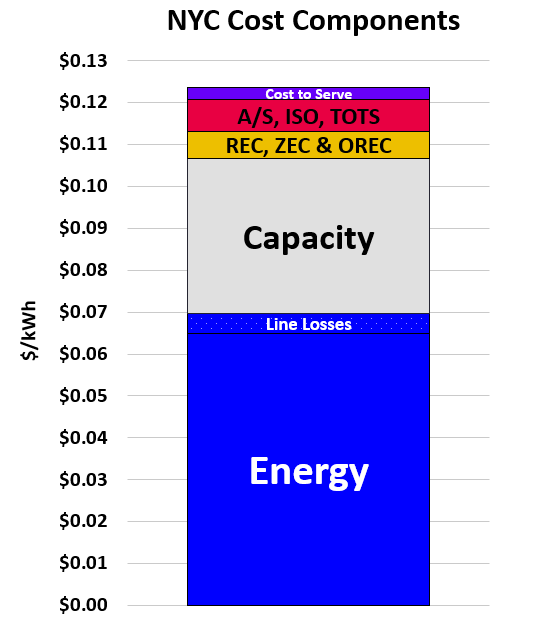

Many are surprised to learn that there are several cost components that are added together to establish the rate in cents per kilowatt-hour in an electricity supply contract. Those components are summarized in Figure 1, which shows that the two largest are energy and capacity. It’s important to note that both energy and capacity are market-based, which means that the price of both is based on the forces of supply and demand. And while it may not be obvious, regulations and legislation can have a significant effect on the forces of supply and demand and thus the power markets. Between April 2018 and May 2019, the price of energy in New York City increased nearly 40% largely driven by a carbon tax proposed by the NYISO. Doubts around implementing that carbon tax caused prices to dramatically fall to just fourteen months later. This is an example of how regulatory forces can move market prices. Today, regulations in New York State are causing a dramatic increase in the price of capacity, the second largest cost component in a retail electricity supply price (See Figure 1).

Figure 1: Typical NYC Retail Power Cost Components

Energy prices are based on the wholesale cost of the electricity that is produced by power generators, while capacity prices reflect payments made to generators to ensure that those generating units run during periods of peak electricity demand. Capacity is similar to an insurance payment, made in advance, to maintain a proper balance between electricity supply and demand when the grid is most in need of power. Often, there is an inverse relationship between energy and capacity prices in terms of supply and demand. High power prices tend to lower capacity prices, all other things being equal. But that is not the case today. In 2019, New York adopted the Peaker Rule, which places limits on the ability of fossil-fueled generating assets to operate, even during the hours when the grid is most in need of power as traditionally incentivized through the capacity market. This regulation requires power plants to implement strict pollution controls by 2023 and 2025. Fossil-fueled power plants unable or unwilling to comply with these pollution controls and emissions requirements will be forced to retire. As of May 2023, New York’s Department of Environmental Conservation (DEC) reports that nearly 40 power plants have plans to retire because of the regulations set forth by the Peaker Rule. The reduced supply of peaker plants has been bullish for capacity prices because it means that there will be fewer power plants available to meet the demands of the grid during the hottest days of summer and the coldest days in the winter.

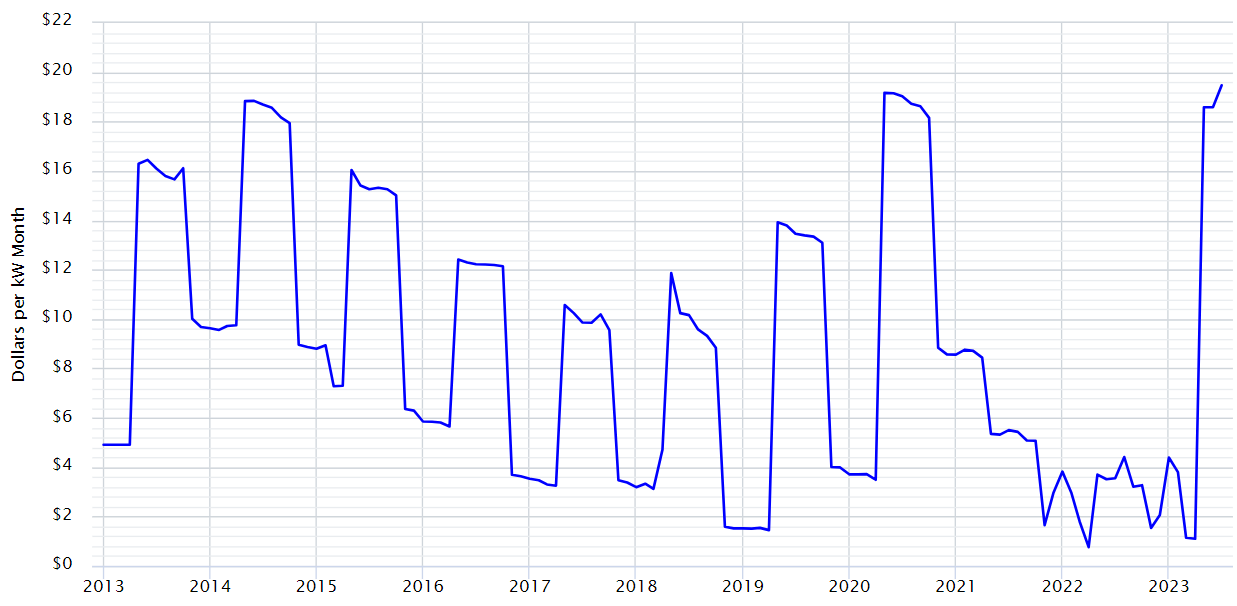

The pending retirement of many peaking power plants in New York has pushed the price of capacity to nearly record-high levels. Figure 2 shows a historical account of spot capacity prices in New York City over the last ten years. In May 2020, capacity prices peaked at $19.17 per kW-month (when power prices were at a minimum due to the demand destruction from the pandemic) and then steadily fell over the next three years as power prices increased. Between April and May of this year, the spot price of capacity increased 10X from $1.66 to $18.58 per kW-month. This is the most dramatic increase in capacity prices in New York City in the last ten years. The aggravating part for electricity buyers is that energy prices have not fallen in the same inverse relationship that they have in the past. When spot capacity prices peaked in May 2020, power prices in New York City were at or near their all-time low. And while forward market prices for electricity have fallen approximately 40% from their highs last September, they are still 70% higher than they were at the onset of the pandemic. Elevated energy and capacity prices are conspiring against most electricity buyers in New York City.

Figure 2: NYC Capacity Spot Auction Results, by 5

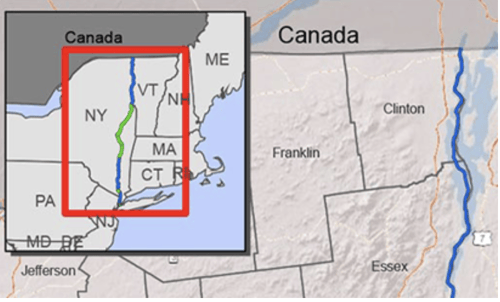

Some relief in Capacity prices may be realized when the Champlain Hudson Power Express (CHPE) transmission line is completed. This project is expected to bring lower-cost and cleaner hydroelectricity and wind power to New York City from Quebec through a high-voltage power cable beneath the Hudson River (See Figure 3). According to the developer, “the CHPE is permitted and expected to be fully operational in spring of 2026, delivering 1,250 MW of low-cost renewable power directly into the New York Metro area.” Skeptics believe it is overly optimistic to expect the CHPE project to be completed in 2026. This unfortunately does not provide any capacity price relief to clients who need to purchase electricity in the next three years.

Figure 3

The most direct way to solve the capacity problem in New York is through the construction of non-fossil-fueled power plants that can operate on demand when the grid is peaking. And unfortunately, there are not enough projects in the queue that will meet the power demands of New York City while also complying with the DEC’s Peaker Rule. Ironically, one of the city’s largest sources of non-fossil-fueled power, the Indian Point nuclear power plant was removed from service two years ago. The retirement of this power plant in addition to those unable to comply with the Peaker Rule has created a capacity problem without any immediate solutions. The market clearly believes that the state does not have enough capacity and heightened capacity prices are likely to remain in place unless there are dramatic regulatory and legislative changes in Albany.