In late January, the Biden Administration paused all LNG export facility applications, so that the Department of Energy (DOE) can assess whether any additional LNG export capacity is in the public interest. There seems to be a little confusion in the general public as to what exactly this pause does to short-term and long-term LNG export capacity and therefore natural gas supply and price. We thought it would be helpful to illustrate what this suspension means in terms of actual natural gas supply and demand.

We will skip the politics of the decision for now and jump straight to the facts of the matter.

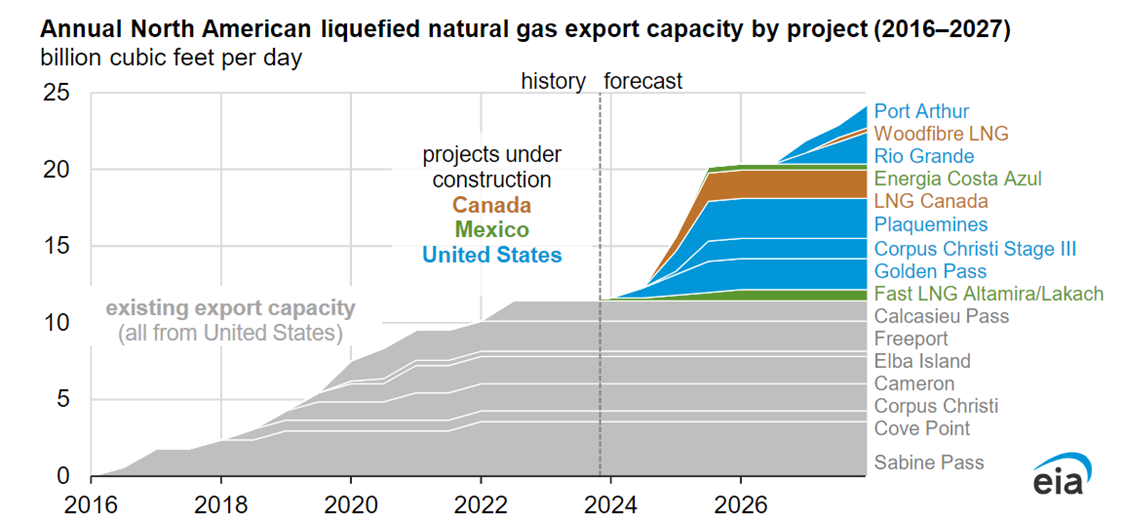

First, this suspension only impacts pending applications requesting to export to countries without a Free Trade Agreement in place with the US 1. That’s the first carve out. Second, there is already 14.28 Bcf/day of export capacity in operation in North America (not affected by this order), and another 12 Bcf/day under construction (also not affected by this order). Finally, there is also another 22 Bcf/day of approved capacity not yet under construction (also not impacted by this order), most of which is still working toward a Final Investment Decision (FID), meaning the developers of the sites are still trying to gather enough long-term contracts to move forward with the construction phase of the project.

All in all, by the end of 2026, North America will have a total daily output capacity of almost 25 billion cubic as shown in Figure 1. To put that into perspective, the total global LNG demand in 2023 was about 400 million tons, which is the equivalent of about 53 Bcf/day. The entire market demand is currently 53 Bcf/day, the US, Canada, and Mexico have 14 Bcf of active export capacity online and another 34 Bcf of capacity under construction, or approved (bringing the total to 48 Bcf). Given that the US is not the only game in town (Russia and Qatar also have another 27 Bcf/day in development), it seems as though our future LNG export capacity might exceed global demand, even with forecasted demand growth 2.

Figure 1: By EIA

The market seems to agree that the suspension will have minimal impact on supply. Key international LNG trading hubs, with TTF (European LNG market hub) and JKM (Asian LNG market hub), continued their slightly downward trend, even multiple years out on the forward curve. Since then, JKM prices for Jan 2027 delivery month on Feb. 12 were trading near $10/MMBtu, sitting at 12-month lows, as shown in Figure 2.

Figure 2: By CME Group

The US benchmark hub, Henry Hub on the Gulf Coast of Louisiana, near the majority of the existing export facilities, did not see much long-term price movement either in the wake of this announcement, with the majority of movement in Henry Hub prices being short-term weather-driven.

A more significant impact from the LNG suspension will be on sustainability initiatives, European and Asian demand for natural gas to offset reliance on Russian exports, and on the domestic economy. Environmental groups oppose additional LNG developments, arguing that these only further extend the development and consumption of fossil fuels. At the same time, the suspension could have a material impact on the European natural gas supply and the domestic US economy. While energy is just one part of the total US economy, it is not a small part, and 2023 saw the lowest net trade deficit in three years at $773 billion, down from $951 billion in 2022. Rough math shows that 20 Bcf/day (current LNG and pipeline exports to Mexico) at $5.50 per MMBtu is about $40 billion additional dollars coming into the economy from abroad, annually. If you double that capacity and natural gas prices get back to a modest $4 per MMBTU, you are approaching $100 billion annually.

LNG story short: This pause does not do much to natural gas prices, at least not over a typical retail buyer’s hedging horizon of three to four years. In the long term, the findings of the DOE’s report could be quite impactful to the local Gulf Coast economy, the US economy overall, the oil and gas industry, and the international relations of those who are signing these long-term tolling agreements with the LNG facility developers.

________________________

1 The United States has Free Trade Agreements with some 20 countries

https://ustr.gov/trade-agreements/free-trade-agreements

2 GlobalEnergyMonitor.org, article on international LNG capacity changes

https://globalenergymonitor.org/press-release/trillion-dollar-lng-stocktake-five-countries-plan-75-percent-of-new-export-capacity-90-percent-of-new-import-capacity-in-asia-and-europe/

DOE Announcement:

https://www.energy.gov/articles/doe-update-public-interest-analysis-enhance-national-security-achieve-clean-energy-goals

White House Announcement:

https://www.whitehouse.gov/briefing-room/statements-releases/2024/01/26/fact-sheet-biden-harris-administration-announces-temporary-pause-on-pending-approvals-of-liquefied-natural-gas-exports/

DOE Approved Facilities:

https://www.energy.gov/sites/default/files/2023-12/LNG%20Snapshot%20Dec%2031%2023.pdf