By most accounts, the winter of 2022/2023 was relatively mild. Only 2.3 inches of snow fell in New York City all winter, which is the lowest snowfall total in the 150 years that the National Oceanic and Atmospheric Administration (NOAA) has been tracking this data. Additionally, the price of natural gas fell 25% from the beginning of December through February on moderate temperatures and lower demand for natural gas used for heating throughout the winter. Despite the mild weather, one winter storm nearly brought PJM’s electricity grid to its knees. Winter Storm Elliott, which occurred between December 22 and December 26 last year, drastically affected power markets across the 13 states that make up the PJM Interconnection. The aftermath of Winter Storm Elliott has added a tremendous amount of uncertainty to PJM’s capacity markets and any new fixed-price retail electricity contracts that go beyond May 2025.

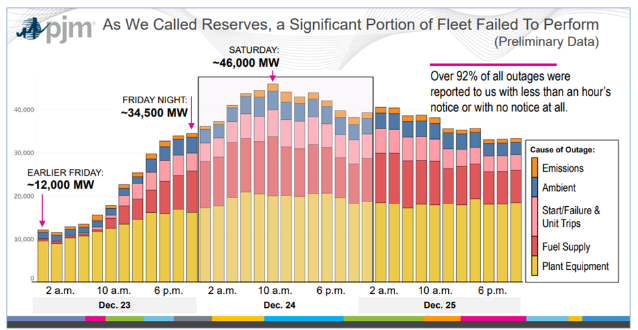

Winter Storm Elliott may not have been an anomaly. This storm was the fifth event in the last eleven years where cold weather-related generation outages jeopardized the reliability of the electricity grid. In February 2021, ERCOT’s electric grid came within four minutes of a complete blackout across Texas from Winter Storm Uri. And while there were no rolling blackouts during Winter Storm Elliott, many describe last year’s storm as a “close call” with disaster. As reported in 5’s February Market Letter, more than 23% of PJM’s entire generation fleet was offline during last year’s storm. Figure 1 shows the extent of the outages in PJM during Winter Storm Elliott.

Figure 1

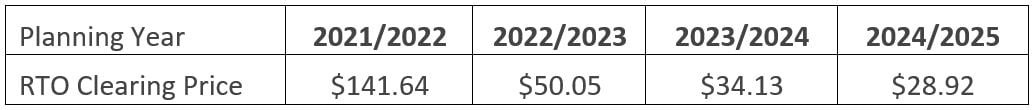

Capacity markets are designed to ensure that there is enough electricity supply to meet the demand that is placed on the electricity grid. The cost of capacity is included in all PJM’s retail power structures to account for payments that are made to generating assets for their promise to produce power when demand is high and their generation is called on to provide power. The price of capacity can be as much as 30% to 45% of the supply portion of one’s electricity rate. Oddly, prices for capacity in auctions held only two months after the storm were flat to down across PJM compared to prior auctions. For the planning year June 2021 to May 2022, capacity prices were nearly an order of magnitude higher in certain parts of PJM. For example, capacity prices in Com Ed (IL), BGE (MD), and PSEG (NJ) were close to $200/MW-day while the average capacity price approached $150/MW-day in PJM’s capacity auction in February 2023. Changes in the Regional Transmission Organizations (RTO) clearing price are shown in Table 1.

Table 1: By 5

The data in Table 1 shows that PJM’s marginal price for capacity fell from $141.64/MW day to $28.92/MW day, or nearly 75% over the last four auctions. Lower capacity prices suggest that the market believes there is enough generating capacity in PJM to keep up with demand on the coldest and hottest days of the year. This is clearly not the case since many generating assets were unable to perform when called upon during Winter Storm Elliott. PJM and other stakeholders are questioning the value of natural gas-fired generators and other power-generating assets when electricity is most needed. There is no doubt that changes to PJM’s capacity market are required to ensure the stability of the electricity grid.

The bottom line is that significant improvements are necessary in PJM’s capacity model and time is running out. The next capacity auction is scheduled for June 2024, which would set the price of capacity for the June 2025 to May 2026 planning year. It is possible that market reforms may be approved and implemented in the next seven months. It is also possible that the auction may be delayed as in the past. Regardless, uncertainty is never a good thing in any market and the questions around how capacity will be priced in the future will certainly manifest itself in the form of higher prices and premiums for electricity in PJM beyond May 2025. Even fixed-price contracts currently in place for months beyond May 2025 could be subject to change as suppliers may invoke change-of-law provisions in their contracts if significant modifications are made to the way capacity is valued.

As past events have shown, the harshness of a given winter does not guarantee grid stability. A single significant storm, exemplified by Winter Storms Uri and Elliott, can push an electricity grid to its limits. The real question is whether the capacity market modifications in PJM will be significant enough to send the proper incentives and price signals to generators to produce the electricity necessary during periods of peak winter demand. In the near term, all one can do is hope that the El Niño weather pattern reduces the chances of a severe weather event this winter, and looking ahead, customers in PJM should prepare for higher capacity costs.