Why are power prices increasing throughout New York?

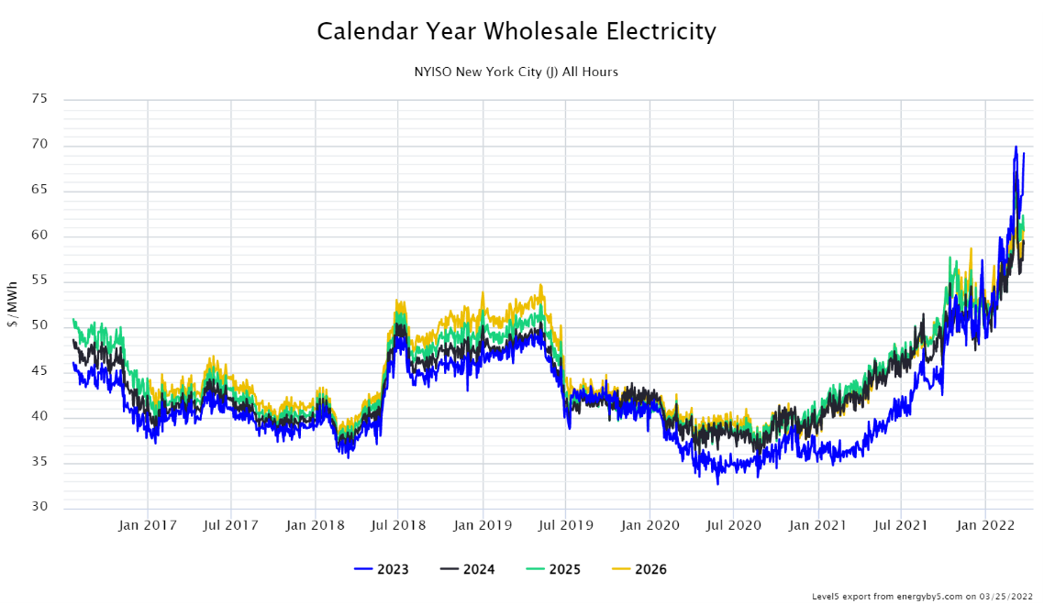

Like many other commodities, the price of wholesale electricity has drastically increased over the last 12 months nationwide. In the middle of March 2021, the wholesale price of electricity purchased for calendar year 2023 in NYC was trading at $35.60/MWh. Today, as shown in Figure 1, that calendar strip is trading at $67.89/MWh. The same dramatic rise in energy prices has occurred in Upstate New York as well. The wholesale price for electricity in calendar year 2023 has increased from $24.57/MWh to $42.97/MWh over the last year.

This nearly two-fold increase in the price of electricity is shocking not only in magnitude but in the short time frame in which these changes have occurred. Both foreign demand for domestic LNG and the Russian invasion of Ukraine have certainly had a significant effect on electricity prices. But at the same time, bear market forces have been consistently putting downward pressure on electricity prices for more than ten years in New York and in other parts of the country. That decade-long market paradigm has shifted to a different reality that is dominated by bull market forces, both domestically and overseas. Determining a new purchasing strategy amid these new market dynamics is challenging, to say the least, but recent market movements have created a slight silver lining.

Figure 1: Calendar Year Wholesale Electricity NYISO New York City (J) from 5

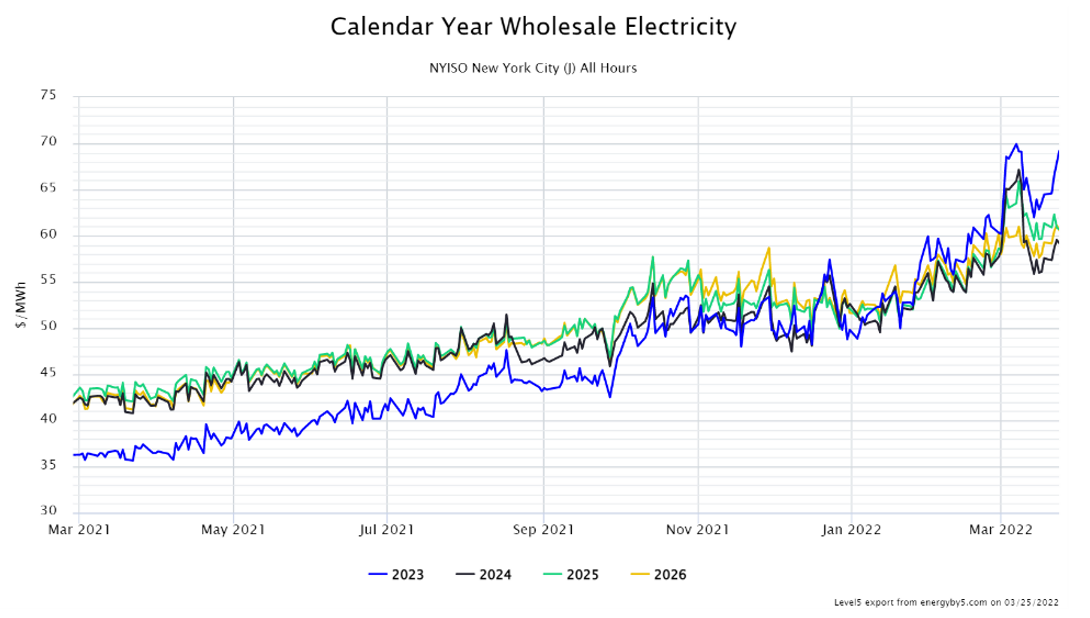

Figure 2 zooms in to focus on only the last 12 months of wholesale trading data shown in Figure 1. Note that for most of last year, calendar year 2023 was trading at a discount to calendar years 2024 through 2026. Additionally, there was little price separation between calendar years 2024, 2025, and 2026. For the most part, this was a contango market where longer-term electricity prices were more expensive than prices in the near-term. That began to change in December 2021 and in the first quarter of 2022 as wholesale prices for calendar year 2023 started to climb. Since the beginning of March, calendar year 2023 has become the most expensive 12-month strip, and calendar year 2024 has become the least expensive strip. Buyers with open positions in 2023 may want to consider purchasing some of calendar year 2024 to lower the weighted average price. And while this will not counteract the drastic market movements of the last year, adding an extra year and capitalizing on some degree of market backwardation is something to consider that can offer some relief to already high prices.

Figure 2: Calendar Year Wholesale Electricity NYISO New York City (J) from 5

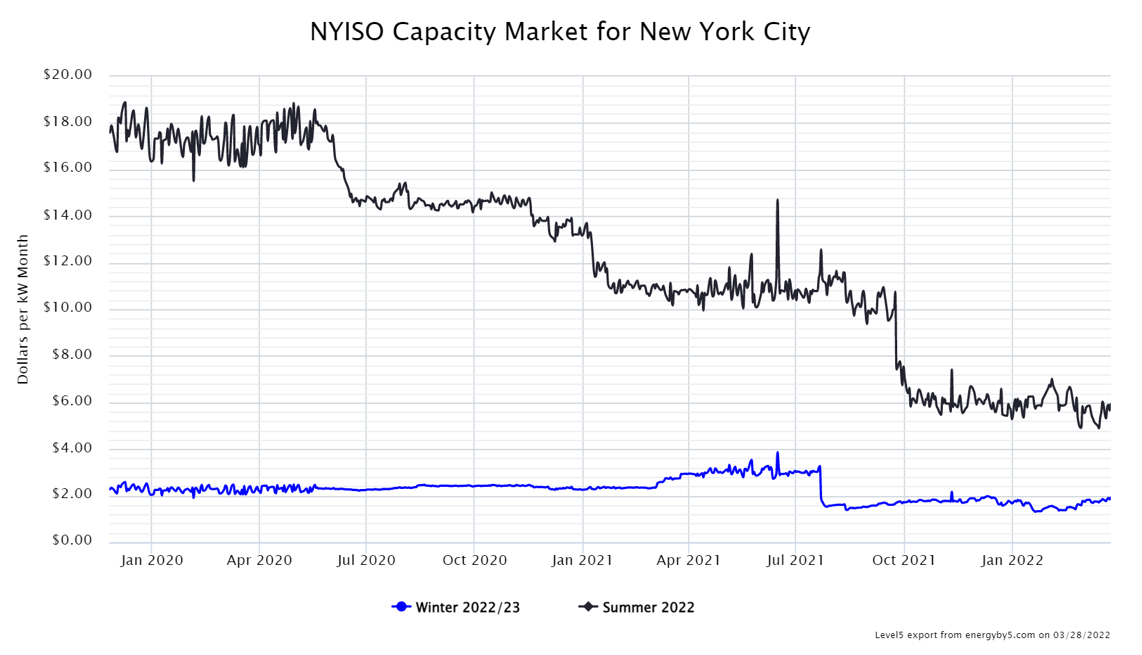

Some additional good news can be found in New York’s capacity market prices, which is the second-largest cost component of a retail electricity price. The cost of capacity reflects payments that are made to electricity generators to ensure that those generating units run during periods of peak electricity demand. Capacity is similar to an insurance payment, made in advance, to maintain a proper balance between electricity supply and demand. In New York, there is a market price for capacity that is traded separately from the price of wholesale electricity. Figure 3 shows how the price of capacity for the next summer and winter has traded since January 2020. Note that while energy prices have been rallying since late 2020, capacity prices for this coming summer and winter seasons have sold off sharply, with this summer now trading at a third of the rate from early 2020. And while energy is the largest and most volatile component of a retail electricity price, falling capacity prices will provide some relief to offset massive increases in energy prices.

Figure 3: NYISO Capacity Market for New York City from 5

Clients open to a structure other than a fixed price should consider a different electricity purchasing strategy, given the proposed increases in delivery costs included in Con Ed’s latest rate case and the bull market forces that have set in. One of the most common questions clients ask when purchasing electricity or natural gas is, “How much money will this save me?” That question is no longer relevant in a bull market. Today, the question is how to mitigate price risk in a market that has more forces at work that are increasing energy costs.

Many clients with electricity contracts ending in the next 12 to 24 months are faced with rates that are significantly higher than their current contracts. One way to alleviate the sticker shock when looking at renewal prices is to shift to a purchasing plan where a percentage of the electricity required is purchased at different stages over the duration of the contract rather than simply signing another fixed price contract. With this approach, clients can fix a certain percentage of the electricity they need while keeping some positions open. Those open (or floating) positions are then closed out (purchased) at opportune times when there are corrections or dips in the market. Purchasing power in a bull market certainly presents challenges and can add a layer of complexity to energy management but your 5 energy advisor can help you to evaluate options and develop a plan that works for your business.