On behalf of the team at 5, I am pleased to forward our September market letter. If you had any doubts that the energy transition is happening, recent events in Texas and New York confirm that the answer is yes. As discussed below, these states have very different approaches to energy regulation, and both have struggled to incorporate intermittent resources in the energy mix. For clients in Texas, New York, or any other deregulated market, planning for the challenges of the energy transition, including increased regulatory risk, should be a key component of your energy management strategy.

AUGUST IN TEXAS: WIND GENERATION CHALLENGES THE GRID

Regulatory Background: Texas provides a good example of a regulatory structure that leverages the free market to develop sufficient energy generation. Although it has minimal renewable mandates, Texas leads the country in renewable power development. This has been driven by several factors including flexible permitting rules, available land, and strong wind and solar resources. Today, there are about 37,000 MWs of wind and 17,000 MWs of utility-scale solar installed and operating in Texas. At the same time, New York remains well behind with only 2,191 MWs of wind and 4,350 MWs of solar ( 4,255 behind-the-meter and only 95 MW front-of-the-meter).1

While the volume of installed generation in Texas suggests that the free market is a preferable regulatory framework, energy regulations are not the only reason that the state has so much wind and solar capacity. Part of the explanation for Texas’ success is geography – the state has ample land and excellent wind and solar resources, both lacking in New York. Texas’ success in developing vast amounts of wind and solar generation also presents new challenges to its energy market. As we saw during Winter Storm Uri and again this summer, the Texas grid is struggling to provide a reliable supply of electricity at a reasonable cost.

August Price Spikes: As everyone knows, the heat returned to Texas this summer. Average temperatures in August were at or near all-time record highs. Sustained heat put significant pressure on the state’s electricity grid and drove spot electricity prices to record levels. The around-the-clock price in the Day Ahead Market for North Texas in August was around $266/MWh or 26¢/kWh. This compares to an around-the-clock price in August 2022 of $101/MWh or 10.1¢ /kWh. The retail price faced by someone exposed to the spot market last month was approximately 26¢/kWh. High temperatures and the related demand for electricity were necessary but not sufficient to drive up the price of electricity. Texas’ increasing reliance on wind generation also played an important role in the August price spikes.2 On the hottest days in August, sufficient wind speeds kept electricity prices under control. However, when the wind failed to blow, prices spiked when demand peaked in the afternoon and again when the sunset, and solar supply fell at a rate faster than energy demand declined.

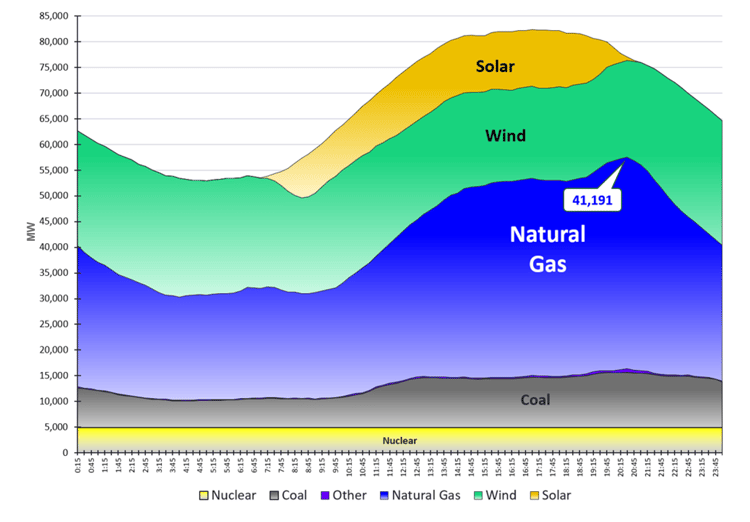

Texas is the first state to struggle with intermittent wind resources.3 The impact of variable wind speeds on electricity prices was very clear this past August. Figure 1 shows the generation mix in Texas on a day with both high demand (over 80,000 MW at the peak) and high wind generation.

Figure 1: ERCOT Generation by Fuel Type, chart by 5

On this day, wind contributed over 20,000 MWs of supply throughout the day. Solar generation, limited to the period between sunrise and sunset, complemented the power produced from wind assets. With the benefit of abundant wind, the state needed only 41,191 MWs of natural gas generation, and this occurred when the sun set at around 8:30 p.m. Interestingly, there does not appear to be any direct correlation between high temperatures and high or low wind volume. On July 18, 2023, the temperature in Dallas peaked at 102º, while the humidity made it feel like 109º.

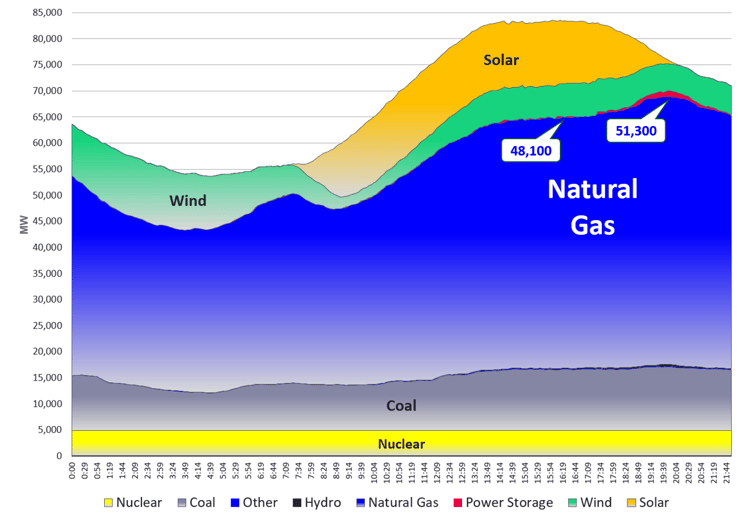

Figure 2 shows the generation mix on August 25, 2023, another day with high temperatures and high demand on the grid. However, on this day, the wind was not as strong as it was on July 18. Total energy demand was well over 80,000 MWs and on this day, the temperature in Dallas peaked at 104º, with low humidity levels that made it feel like it was 104º.

Wind generation peaked at around 7,000 MWs between 3 a.m. and 4 a.m.

Figure 2: ERCOT Generation by Fuel Type, chart by 5

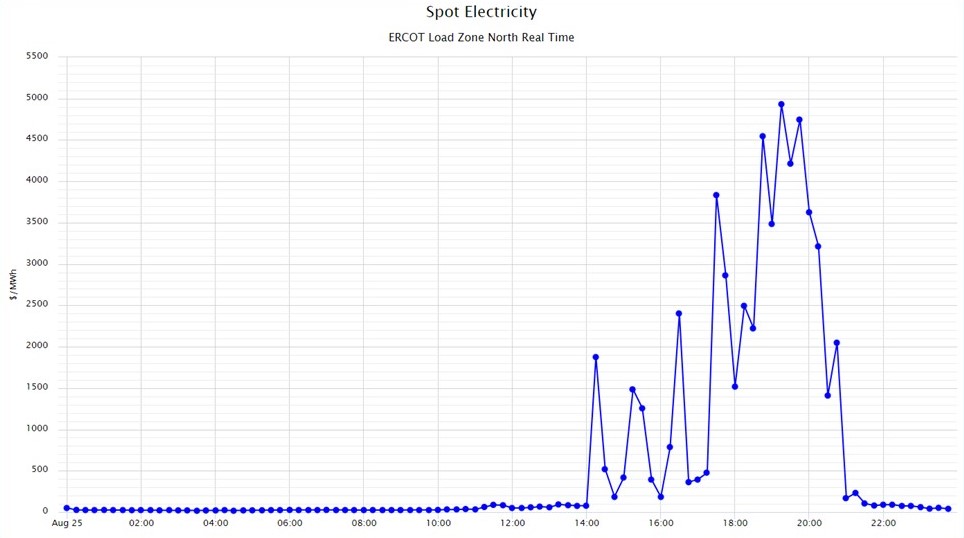

Without significant wind output, the grid operator, ERCOT, had to call on all available natural gas-fired generation and battery storage to keep up with rising demand. One can see that this occurred around 3:30 p.m. when over 48,100 MWs of natural gas generation was called upon. Then, between 5 p.m. and 7 p.m., during the afternoon commute, load drops faster than solar generation declines. Once everyone is home and the sun has set, ERCOT must look to additional gas-fired generation and battery storage to meet the evening peak. At approximately 7:30 p.m., some 51,300 MWs of natural gas generation was needed to keep the grid stable. Spot electricity prices on August 25 (Figure 3) show what happens when the wind does not blow, and the grid must call on its most expensive battery and natural gas power plants. In the late afternoon and early evening of that day, the electricity price rose to levels at or near the highest spot price allowed by ERCOT, $5,000 MWh.

Figure 3: Real-Time Prices in ERCOT Load Zone North for 8/25/2023, chart by 5

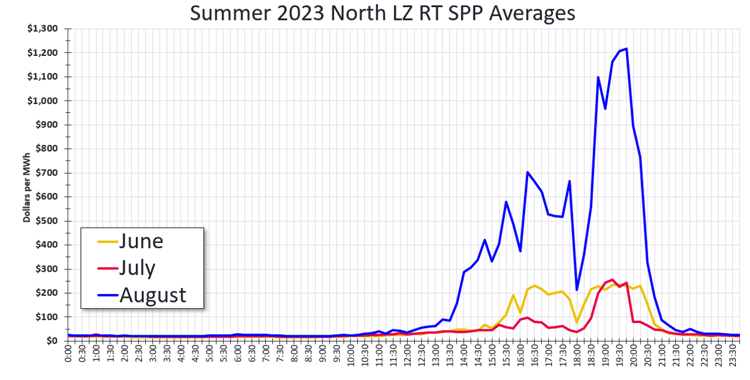

These frequent afternoon and evening price spikes drove up the average hourly afternoon prices for all summer months, but especially during the month of August. This trend has continued into September, to the point where on September 6, ERCOT got dangerously close to rolling blackouts.4 Figure 4 shows the extremely high electricity prices set in Texas this past August in relation to prices in June and July.

Figure 4: Real-Time Prices in ERCOT Load Zone North for 8/25/2023, chart by 5

Even in Texas, a market that prides itself on letting supply and demand set price without regulatory interference, this regulatory construct breaks down when prices are too high, or reliability is at risk. The number of regulatory changes put in place following Winter Storm Uri is proof that Texas’ reliance on the free market has its limits. Programs initiated in Texas that directly compensate generators outside of the price of energy include:

- Firm Fuel Security – Purchased by ERCOT from generation units that can operate using on-site fuel during periods of extreme cold.

- ERCOT Contingency Reserve Service (ECRS) – Offline generation that can come online within 10 minutes and operate for at least 2 hours.

- Increased purchase of Non-Spinning Reserves – Offline generation that can come online within 30 minutes and can operate for at least 4 hours.

- Dispatchable Reliability Reserve Service – a new ancillary service that is not yet fully defined and will enter the market in December 2024. What constitutes a “dispatchable” asset is not yet defined and may include batteries.

- Performance Credit Mechanism (PCM) – new revenue paid to generators that operate during hours of lowest reserve margins.

- SB 2627 – loan subsidies for the construction of new natural gas generation (see additional discussion below).

These changes, the majority of which are included in the definition of “ancillary services” and purchased by EROCT in the Day Ahead Market, are now starting to appear as a line item in retail electricity contracts and utility bills. As a greater percentage of electricity costs shift from an energy cost to an ancillary cost such as those listed above, it is important to understand how these charges are determined and treated in retail contracts and accounted for in budget projections. These calculations are not simple. We recommend that you contact your representative at 5 to get a better understanding of these new ancillary charges and their impact on your energy costs.

It is too early to tell if high prices in August and the near rolling blackout in September will result in additional changes in market rules or new costs to consumers. Certainly, however, these record-high prices and the near outage earlier this month should provide additional voter support for SB 2627. This bill establishes up to $7.2 billion in low-interest loans to support the construction of new dispatchable generation – primarily natural gas. While SB2627 was passed by the legislature and signed by the governor, it cannot be funded without approval from Texas voters. This bill will be on the ballot in November, and we expect it may be easier to get voter support after voters have seen and paid their August electricity bills.

While high energy prices may result in additional governmental regulation, they will also encourage a free market response. Before turning to New York, we should note that the extremely high prices paid to generators this summer will help address the risk of future shortages. Texas remains a developer-friendly state. Today, there are over 10,000 MWs of security-posted utility-scale batteries and over 20,000 MWs of security-posted solar in the ERCOT interconnection queue. Once SB2627 gets approved by voters, there will likely be a long line of developers looking to build natural gas plants as well. Like all transitions, the road will be bumpy, but we do not expect these bumps to stop Texas’ transition to a market increasingly dominated by intermittent resources.

NEW YORK: CHALLENGES ABOUND

While Texas is seeing some of the challenges that come with a hands-off approach to energy regulation, New York’s regulators are seeing the challenges that come with a hands-on approach to managing the energy transition. New York is a good example of a market that leans on its regulators to set and implement energy policy. This is very clear in renewable energy development. First, the state passed aggressive renewable mandates that require, among other things:

- 70% of the state’s electricity must come from renewables by 2030

- 6,000 MWs of distributed solar generation by 2025

- 3,000 MWs of energy storage by 2030

- 9,000 MWs of offshore wind by 2035

- Eliminating GHG emissions from electricity generation by 2040

Second, the state gave the New York State Energy Research and Development Authority (NYSERDA), a state agency, a virtual monopoly over the renewable energy market. The state mandated that NYSERDA procure renewable energy on behalf of all New York consumers. To do this, NYSERDA has run a series of auctions and awarded long-term contracts to developers of renewable energy projects. These developers use NYSERDA contracts to finance and build the plants. Mild temperatures this summer in the Eastern United States kept the pressure off New York’s grid operator, the NYISO. The challenge in New York is cost.

Meeting Renewable Goals: Can New York Afford The Energy Transition: Acting through NYSERDA, New York State has managed the procurement of almost all the state’s renewable resources. NYSERDA has negotiated multiple contracts with developers to build the renewable power required to meet its goals. However, reliance on a state agency does not come without political risk. One of the justifications for deregulation in New York in the late 1990s (and other markets) was to get the state out of the business of deciding when, where, and how to build generation. Those who were around in the 1980s still remember the political fallout from the closure of the Shoreham nuclear plant built on Long Island, a $6 billion dollar mistake that was passed on to New York ratepayers. The regulators who gave NYSERDA a monopoly over renewable power development were not thinking about Shoreham. If they were not thinking about the risks that come with generation development when they gave NYSERDA its monopoly, they certainly are now.

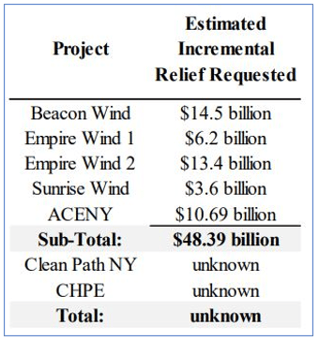

On June 7, 2023, 86 onshore wind and solar projects (acting through a common organization, the Alliance for Clean Energy), filed at the New York State Public Service Commission (PSC) for an increase in the purchase price negotiated when these contracts were awarded in 2016 and 2022. The developers argue that Covid’s impact on the supply chain, inflation, and a dramatic rise in interest rates make these projects unprofitable at the contracted price. These contracts total some 7.54 GWs or 10% of the state’s projected 2030 load. On the same day, four developers of offshore wind projects that had been awarded contracts with NYSERDA also filed petitions with the PSC for rate increases. These projects, Sunrise Wind, Empire Wind 1, Empire Wind 2, and Beacon Wind were awarded contracts with NYSERDA in 2019 and 2022 and together compromise another 4.23 GWs. A week later, Clean Path New York, the developer of a transmission line that was awarded a contract with NYSERDA in 2021 to construct a line that will bring renewable power from Western New York to New York City, filed a petition to increase its revenue. Clean Path is expected to generate another 3.8 GWs of clean energy. Not wanting to miss the party, Champlain Hudson Power Express (CHPE) filed with the PSC to increase the amount paid for certain transmission related costs.6

This is a high-stakes game of chicken. The petitioners seeking higher rates know that New York cannot meet its renewable goals without the successful implementation of these projects. At the same time, we may be reaching a limit as to how much consumers are willing to pay for greenhouse gas reductions. This point was made by New York’s Comptroller in an August 2023 report on renewable energy, which noted that all costs associated with the energy transition are borne by energy customers through higher rates. The Comptroller’s report also claims that these costs could go up significantly if the PSC accepts the repricing petitions. Currently, the PSC and others are digging into the repricing requests and seeking to determine the impact on ratepayers. Figure 5 lists the increased cost, by project, based on filings to date.

Figure 5: Comments filed in NY Department of Public Service Case 15-E-0302 regarding the Large-Scale Renewable Program and a Clean Energy Standard on September 6, 2023, by Multiple Intervenors.

NYSERDA estimates that the offshore wind and Tier 1 project price adjustments will cause residential bills to increase by $4.67/month. This cost increases with volume. For example, an industrial user of 1.3 million kWh per month will see an incremental bill increase of some $120k per year. These bill increases do not include the billions of dollars in additional costs requested by Clean Path New York and CHPE.

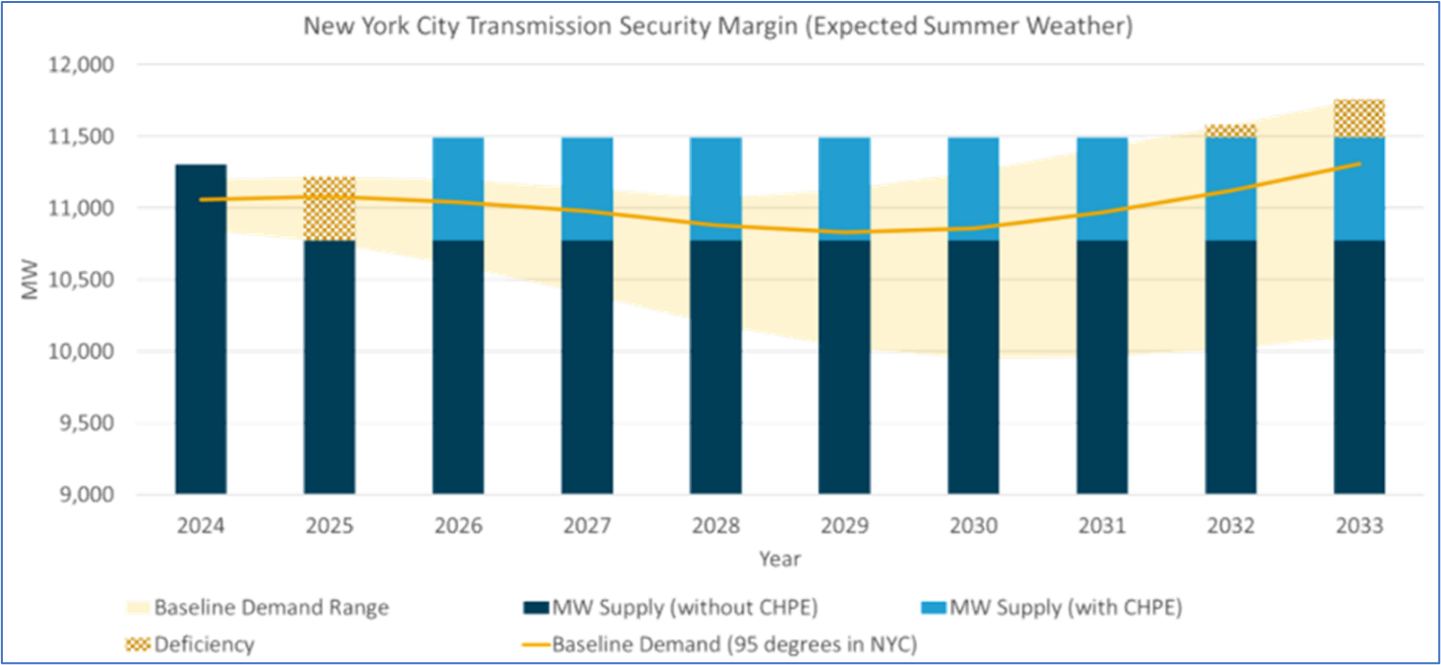

Reliable Supply: Is There Enough Power to Supply New York City? While New York is addressing repricing, the state is facing a new challenge also faced by Texas - reliable electricity supply. At a high level, fossil plants (coal and natural gas) are being retired faster than renewable plants are being built. The state’s system operator, the NYISO, issued its STAR (Short Term Assessment of Reliability) Report in July. In this report, the NYISO said that, due to the expected retirement of natural gas peaker plants, New York City could see a shortage of 446 MWs in 2025. This shortage will be considerably worse if the CHPE line, a transmission line bringing power from Quebec to New York City, is delayed. Figure 6 shows the extent of the potential shortage with and without the CHPE line.

Figure 6: NYC Transmission Security Margin from the Short-Term Assessment of Reliability: 2023 Quarter 2 Report issued on July 14, 2023 by NYISO.

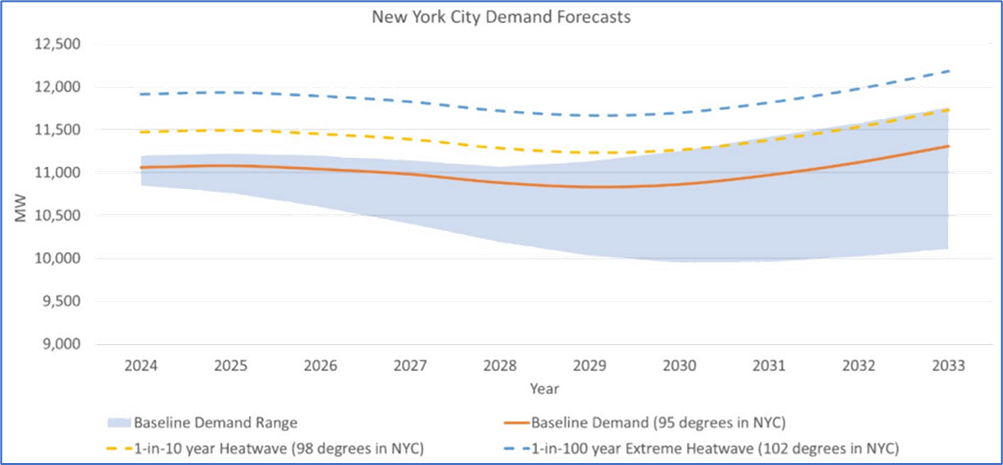

Additionally, as shown in Figure 7, one can see that in New York City electricity demand is very sensitive to temperature. It takes only a 3-degree increase in temperature to increase demand by 500 MWs.

Figure 7: NYC Demand Forecasts from the Short-Term Assessment of Reliability: 2023 Quarter 2 Report issued on July 14, 2023 by NYISO.

And if this past summer in Texas is any indication of what can happen, the potential shortage in NYC could well exceed 500 MWs.

We will see what the state does in response to the NYISO report, and if some of the state’s renewable goals are adjusted to ensure reliability. At the same time, consumers (especially those who need reliable supply) must consider the increased risk of an energy shortage when developing their long-term energy plans.

CONCLUSION

One thing is clear, New York and Texas both find themselves struggling with the energy transition. While critics with various political perspectives can point to political or regulatory action or inaction as the cause of these challenges, the simple fact is that the energy transition is difficult. Incorporating wind and solar resources into our energy grid has and will create unexpected problems that are not simple to solve. The solutions are also likely to be more expensive than policymakers and regulators forecast. We look forward to working with you to manage these challenges in the months and years ahead.

Download the PDF version here.

[1] New York ISO Overview of NY Renewables in 2022 issued in April.

[2] In prior market letters, we discussed California’s struggle to integrate its large volume of solar generation into an energy grid that was not designed to manage intermittent resources. In California, the most difficult times are when the sun rises in the morning and vast amounts of generation come to market and when the sun sets in the evening and all that solar generation shuts down and must be replaced by other sources.

[3] This should not be a surprise to ERCOT. The United Kingdom faced the same issue when there was low wind generation at various times over the past few years. In fact, low wind was a cause of price spikes in the UK in September 2021 and December 2022.

[4] EROCT issued an EEA2 alert on September 6th, this is only issued when operating reserves drop below 1,750 MWs.

[5] A recent Bloomberg investigation claims that generators are using ECRS to manipulate the price of energy in the ERCOT market. Bloomberg Investigation

[6] New York is not the only state that is facing a request to renegotiate fixed price contracts with renewable developers. Other jurisdictions facing similar challenges, particularly with offshore wind projects, include New Jersey, Massachusetts, California, Hawaii, Maine, Indiana and Michigan.