“Sue” is the nickname given to the largest and most complete T. Rex specimen ever found. Today, she has a place of distinction in the Field Museum of Natural History of Chicago. And while Sue most likely died 67 million years ago, she seems to have come to life again in the wake of the New Jersey Board of Public Utilities (NJBPU) TRECs program through its successor - “SuSI”.

4 min read

Predicting 4CP Should be an Olympic Sport

By 5 on July 30, 2021

Our head of analytics and Sr. Zoltar, Eric Bratcher, is a big lover of the Summer Olympics, especially the less popular sports. On Tuesday this week, while Eric was watching ERCOT’s load again come in under forecast, women’s skeet shooting was on in the background. Eric was glued to the final round as USA’s Amber English held off Italy’s reigning champ to win her first gold medal in the event. An hour later, USA’s Vincent Hancock set an Olympic record of 59 of 60 targets, winning his event and being awarded with his third gold medal.

Topics: Markets ERCOT

4 min read

Gas Prices Vault Over Prior Lows

By 5 on July 30, 2021

Global natural gas markets are finally starting the rally that many producers had been anticipating in recent years. Last year, global demand for LNG dropped so precipitously that some LNG buyers elected to pay LNG liquidation terminals their contractually obligated tolling agreement payments and canceled their delivery of the actual commodity. Subsequently, last summer spot prices for the Japan/Korea Marker (JKM, the Asian LNG version of the Henry Hub natural gas trading hub in the US) traded below $3 per MMBtu. On July 28 of this year, the future contract for September LNG delivery was trading around $14.50 per MMBtu. Figure 1 shows that the JKM price for LNG has increased three-fold over the last year.

Topics: Markets Natural Gas

2 min read

PJM Capacity Auction Clears High Hurdles

By 5 on July 30, 2021

The big energy news in PJM this summer was the completion of the first capacity auction in three years, which was held in late May. This was an important event on several fronts. Most importantly, the price for capacity in all parts of PJM was set for the period of May 2022 through June 2023. As shown in Figure 1, the price of capacity is typically the second-largest cost component of a retail electricity agreement, and like any other commodity or security, uncertainty creates risk and increases cost. This recent capacity auction provides the transparency necessary to reduce risk premiums associated with this important cost component.

Topics: Markets PJM

3 min read

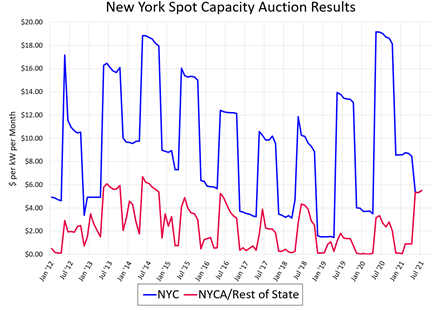

Synchronized Swimming for NY Capacity Prices

By 5 on July 30, 2021

For as long as we can recall, there has been a significant difference between the price of capacity in upstate New York compared to capacity prices in New York City. It was common for capacity to trade at $3 to $5/MW-day in upstate New York and $15 to $18/MW-day downstate.

Topics: Markets NYISO

12 min read

July 2021 - Quarterly Market Letter

By Jon Moore on July 20, 2021

On behalf of the team at 5, I am pleased to forward our market letter for the second quarter of 2021. The unusual weather that caused historic outages and extreme electricity and natural gas prices in Texas in Q1 surfaced in other markets in Q2. Both the Pacific Northwest and the Western US faced extreme weather conditions, namely, heat. In Death Valley, temperatures hit 130 degrees on July 9, a world record for the hottest reliably measured temperature in recorded history.

Topics: Markets Natural Gas ERCOT Newsletters Education Resiliency

4 min read

Austin Delivers Lots of Bills but Little Relief

By 5 on June 29, 2021

Ever since Winter Storm Uri devastated Texas in February, politicians in Austin began to debate what went wrong and how to implement legislation that would prevent another storm from having similar effects. Both the House and the Senate passed multiple bills at the end of the state’s 87th legislative session on May 31, 2021.

Topics: Markets ERCOT

5 min read

Natural Gas Fundamentals, Not Fun at the Moment

By 5 on June 29, 2021

NYMEX Henry Hub Natural Gas prices continue the strong rally that began in March with a persistent increase in prices extending all the way back to the onset of the pandemic at the beginning of 2020. Natural gas prices for the prompt month, balance of 2021, and future calendar years are all moving in the same direction. These sharp price increases can be seen in the NYMEX forward curves in Figure 1. And while all gas prices in all calendar years are on the rise, the strongest rally is in near-term prices over the next 18-months (see black, blue, and green lines in Figure 1).

Topics: Markets Natural Gas

2 min read

How to Manage Summer Peak Demand

By 5 on June 29, 2021

It comes as no surprise to energy managers that their electric bills are often the highest during the summer months. This is due, in large part, to the additional electric loads required to keep buildings and facilities comfortable during the hottest days of the year. While the impact on those summer bills may be obvious from a consumption perspective, a less obvious but equally important factor that affects electricity expenses is the installed capacity (ICAP) tag set each summer. In New York, every electricity customer’s ICAP tag is determined by the amount of electricity used when the power grid reaches its system peak. Current New York Independent System Operator (NYISO) rules state that the system peak must occur in July and August on a non-holiday weekday. Last summer, the peak hour occurred at 5:00 PM on July 27, 2020, when the electricity demand on the grid was 30,660 MWs.

Topics: Markets NYISO

4 min read

Delayed Auction, Worth the Wait

By 5 on June 29, 2021

The big news story this summer in PJM has been the auction that set the price for capacity for the period of June 2022 through May 2023. This is newsworthy because there has not been a PJM capacity auction in three years. The delay had been caused by disagreements between the Federal Energy Regulatory Commission (FERC) and PJM, which were at odds over the mechanism by which the price for capacity is set. This three-year delay created uncertainty in how capacity was valued in any forward electricity contract. And like any other security or commodity, uncertainty creates risk premiums and higher costs. Before examining the details of the most recent auction results, it is important to review capacity and why it is important to electricity buyers.