1 min read

Webinar Recording: Upstate New York Energy Markets - April 8, 2025

By 5 on April 8, 2025

Topics: Markets Clients Videos Education Regulatory

1 min read

CO-LOCATION OF DATA CENTERS AND POWER PLANTS: THE REGULATORY CROSSROADS

By 5 on January 14, 2025

Many of the largest data center owners (e.g. Google, Microsoft, and Amazon) are exploring the co-location of data center load adjacent to new or existing power plants. Energy regulators now struggle to come up with rules that fairly address the co-location of energy-intensive data centers.

Topics: Markets Education Regulatory

5 min read

Barriers to a real Nuclear Power Renaissance

By 5 on January 14, 2025

Did you get the Simpson’s Nuclear Power Plant play set with the Homer Simpson action figure for Christmas? No? You must not have been good this year, because it seems like nuclear power is all anyone can talk about in the energy industry lately. This is because many claim that a nuclear power “renaissance” is happening in the United States. Recently, it was reported that companies such as Amazon, Meta, Microsoft, and Google are “betting big” on nuclear power to support their growing needs for electricity for their data centers. Other appealing claims around nuclear power are that it is good for the environment because greenhouse gas emissions are negligible and unlike wind and solar assets, these plants, for the most part, run 24/7. Additionally, unlike solar and wind farms, nuclear power plants use a fraction of the land necessary to produce the same amount of electricity.

Topics: Markets Education Regulatory

2 min read

UNDERSTANDING PJM'S CAPACITY RULE CHANGES: IMPLICATIONS FOR AUCTION PRICES AND GRID RELIABILITY

By 5 on January 14, 2025

On December 9, PJM proposed a series of changes to its capacity rules. These changes are designed to address: (i) the high clearing prices in the 2025/2026 auction, and (ii) the increasing risk of capacity shortfalls. As discussed in earlier 5 by 5s, this capacity shortfall is driven by numerous factors including the construction of new data centers that require significant amounts of electricity, the retirement of older fossil fuel units, and delays in the development of new generation and transmission lines.

Topics: Markets PJM Education capacity

1 min read

Webinar Recording: The Energy Transition

By 5 on November 20, 2024

Topics: Markets Clients Videos Education Regulatory

6 min read

ELECTION IMPACTS ON ENERGY POLICY AND PRICES

By 5 on November 13, 2024

The election was a resounding win for President-Elect Trump and provides him with a clear mandate to change federal energy policy. His ability to implement policies is further supported by the fact that the Republican party now controls the Senate and may control the House of Representatives. In light of this historic shift, we have provided a short summary of the likely energy policy changes to be implemented by the Trump Administration and their impact on energy prices. While our position has been that the outcome of the election will not significantly affect near-term prices, there are factors that may influence prices in the long term.

Topics: Markets Education Regulatory election

3 min read

2024 ELECTION UPDATE

By 5 on October 22, 2024

In late August, we wrote that while the result of the Presidential election will have a significant impact on Federal energy policy, it will not materially affect energy prices. We now have a somewhat clearer understanding of Vice President Harris’ energy policy, and we continue to maintain that while several Biden climate initiatives are at risk, the election will not significantly impact near-term energy prices. In fact, as recently noted by The Economist, “Green subsidies will probably survive Mr. Trump’s re-election, and Big Oil will probably do just fine under Ms. Harris.”[1]

Below, we break down a few of these key energy policies and explain why most are not actually in play.

Topics: Markets Education Regulatory

1 min read

Webinar Recording: PJM Capacity Auction Results and Their Impact to Your Budget Webinar

By 5 on September 26, 2024

Topics: Markets Clients PJM Videos Education Regulatory

2 min read

HOW THE 2024 ELECTION COULD AFFECT ENERGY POLICY AND MARKETS

By 5 on August 29, 2024

The departure of President Biden and the nomination of Vice-President Harris challenges anyone predicting the impact of the 2024 election on energy policy. Unlike President Biden or former President Trump, both of whom have clear track records on energy policy, Vice-President Harris has said almost nothing to-date about her administration’s approach to the energy market or climate change. In her speech accepting the Democratic Party’s nomination, Vice-President Harris did not use the word “energy,” and there was only a single reference to climate change – that we need “[t]he freedom to breathe clean air, and drink clean water and live free from the pollution that fuels the climate crisis.” President Trump’s stance on energy-related policies is better known, and we expect his administration will take regulatory action to help coal, natural gas and nuclear power to better compete with renewables. Notwithstanding this policy shift, our view is that a second Trump administration will not have any significant effect on near-term energy prices. Electricity and natural gas market fundamentals and the overall balance of supply and demand will likely be the main drivers of energy prices over the next six to twelve months regardless of who wins the election in November.

Topics: Markets Education Regulatory

6 min read

Big News in PJM's Latest Capacity Auction

By 5 on August 1, 2024

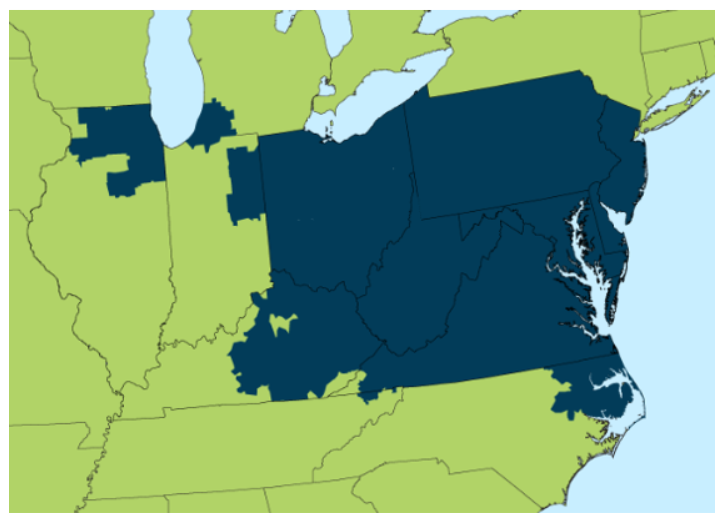

The good news is that we now know the price of capacity through May 2026. The bad news is that capacity prices have increased by approximately 5x over the last auction. The surge in price was fueled by power plant retirements, rising regional demand, and regulatory requirements seeking to address the participation of renewables and how much capacity they can provide during periods of system stress. Before examining the details of this latest auction, it’s important to review how the capacity market got to where it is today. As a refresher, the PJM Interconnection operates the largest competitive wholesale electricity market in the United States, serving 65 million people across 13 states and the District of Columbia as shown in Figure 1. Its primary function is to coordinate the flow of power and develop market rules such that the system operates reliably and safely. A critical component of PJM's operations is its capacity market, which ensures long-term reliability by securing sufficient resources to meet future electricity demand.