If you have been shopping for retail power in Texas, then what we are about to report will not come as a surprise. However, if you have not seen wholesale power prices in ERCOT in a few months, you should probably sit down before you continue.

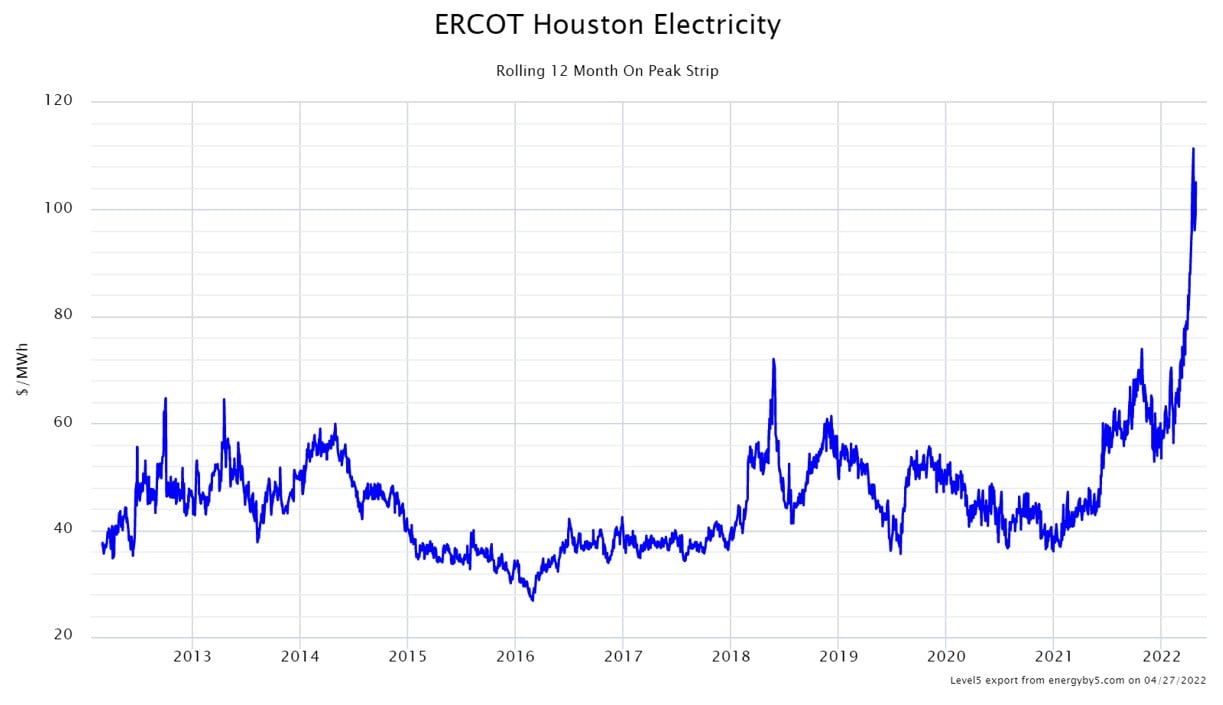

This month’s 5 by 5 article on natural gas gives some insight into that commodity’s volatility over the past few months. And since natural gas is the fuel for the power plants that generate over 40% of the electricity in Texas, it should be no surprise that rising natural gas prices have pushed up electricity prices. Figure 1 shows the 12-month rolling forward on-peak power prices for the Houston Trading Hub, from 2012 to present. Prior to the run of prices this winter and spring, wholesale power prices for the rolling next 12-months typically traded between $40 and $60 per MWh, with an occasional dip below as observed in 2015, or short-term jumps above $60 in 2018. This past fall, prices broke out of that traditional resistance level, and have not looked back since.

Figure 1: ERCOT Houston Electricity Rolling 12 Month On-Peak Strip from 5

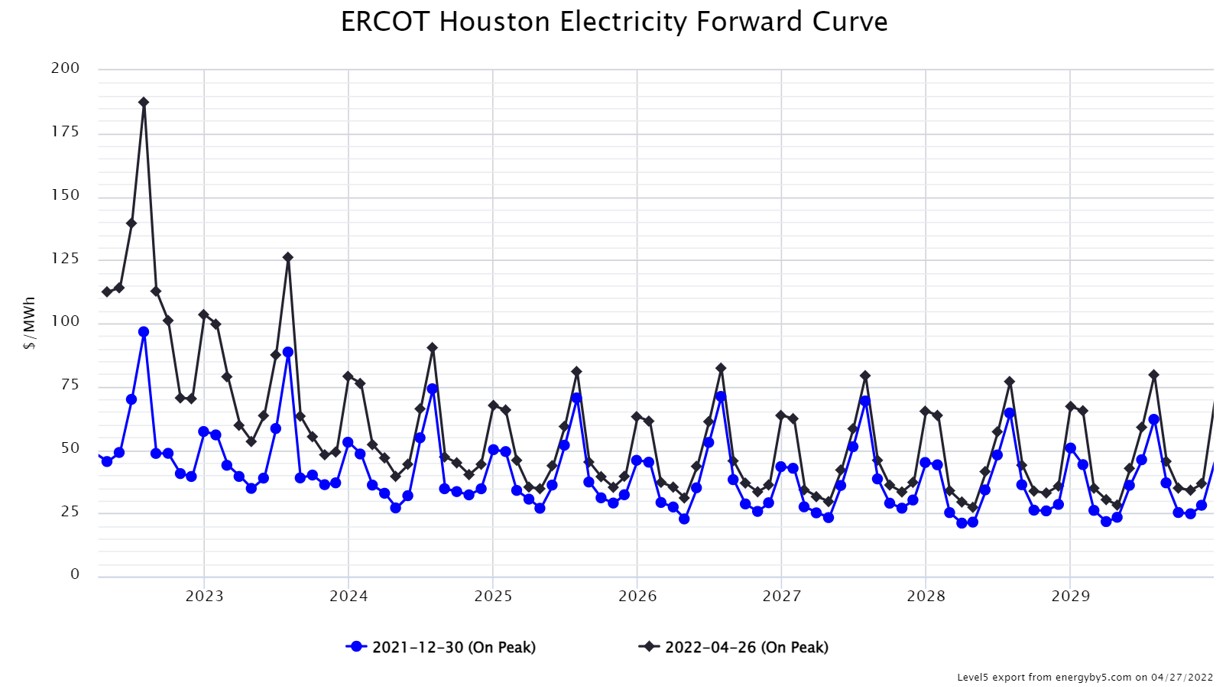

As the market closed on Tuesday, April 26th, the rolling 12-month on-peak strip was trading around $105 per MWh, or 10.5¢ per kWh, for wholesale power. And to make matters worse, the times of the year when Texans use the most power (summer for all of us and winter as well for those using electricity for heat) has risen dramatically since the beginning of the year. Figure 2 shows the Houston on-peak forward curve (the price for each and every forward month at a single point in time) for December 30, 2021, compared to April 26, 2022. This chart shows that the prices for power during the summer of 2022 have almost doubled in the past four months, along with prices for the winter of 2023.

Figure 2: ERCOT Houston Electricity Forward Curve from 5

The good news is that the curve is significantly backwardated (sloping downward into the future or discounted further out the forward curve). This allows buyers trapped in a short position (still needing to buy) for the balance of 2022 to help buy down that price by leveraging the heavily discounted forward years, easing the budget shock produced by the volatility of short-term prices.

And while winter power prices are up due to the rising cost of natural gas, summer power prices beyond 2024 are relatively unchanged due to lower summer heat rates spurred by the large growth in solar capacity.

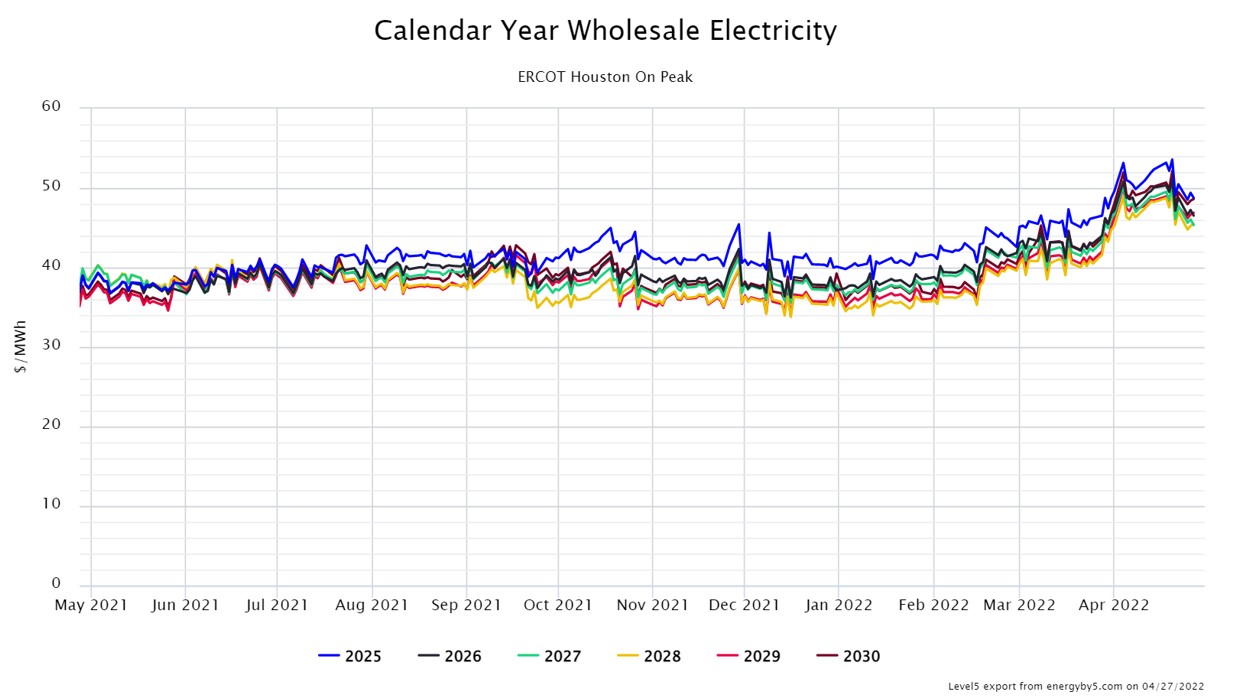

While this market might seem all doom and gloom, and too high to transact in, there are still some bargains in the forward curve. Figure 3 shows that Houston’s on-peak Calendar Year Strips for 2025 through 2030, are all still below $50 per MWh. When you compare that to where the front of the curve is currently trading and look at the historical range for the prompt 12 months, on-peak power under $50/MWh in Houston might seem like a steal. Capitalizing on the relatively low-priced outer years may be a good move since there is more upside risk than downside potential for on-peak power trading in the mid to high $40s.

Figure 3: Calendar Year Wholesale Electricity ERCOT Houston from 5