In many electricity markets, natural gas is often the marginal fuel. This means that gas is the fuel that is used to generate the next additional amount of electricity that is required to ensure that there is enough electricity supply to meet the grid’s demand. Over the last ten years, the amount of natural gas generation in PJM has increased from 25% to nearly 40% of the fuel mix. It should be no surprise that the rise and fall of electricity prices throughout PJM is highly correlated to natural gas price movements.

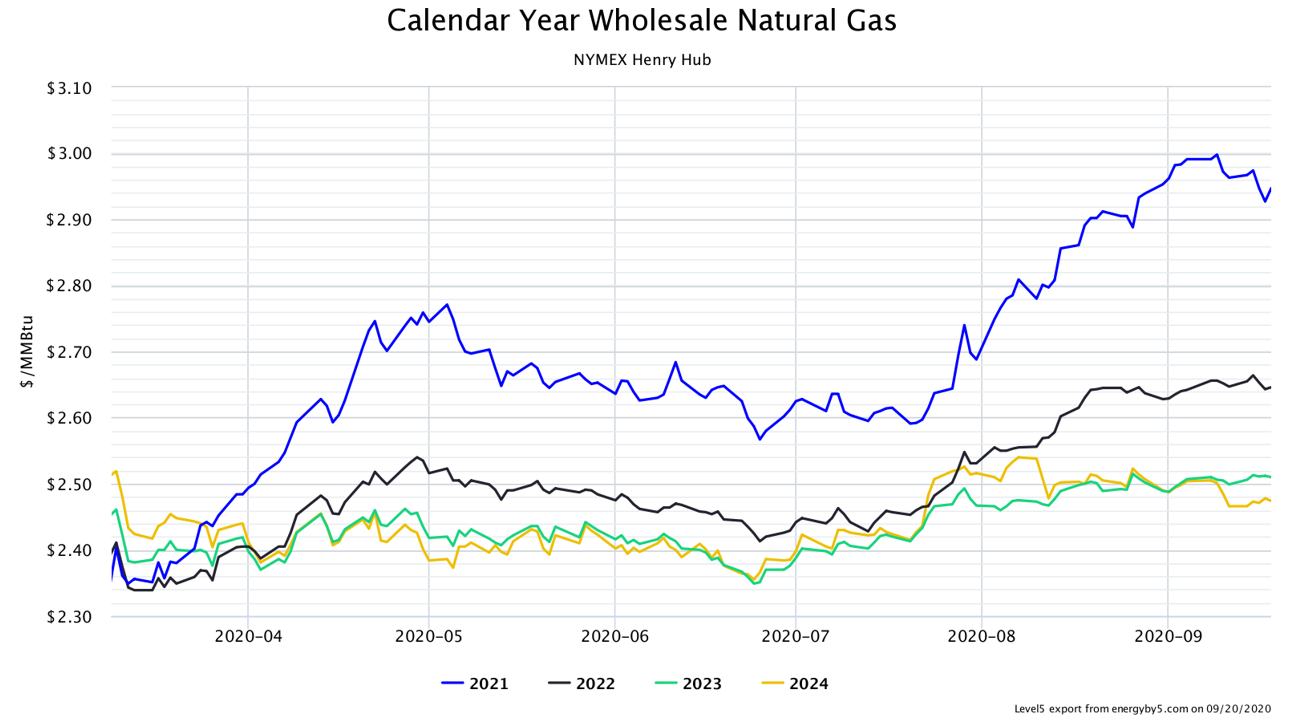

Figure 1 shows how each calendar year’s average price of natural gas for the years 2021 through 2024 have been trading over the last six months. This chart clearly shows that near term natural gas prices for 2021 (blue line) and 2022 (black line) have seen two sustained rallies this year, rising strongly in the spring and then again in the late summer.

Figure 1: Calendar Year Wholesale Natural Gas NYMEX Henry Hub, from 5

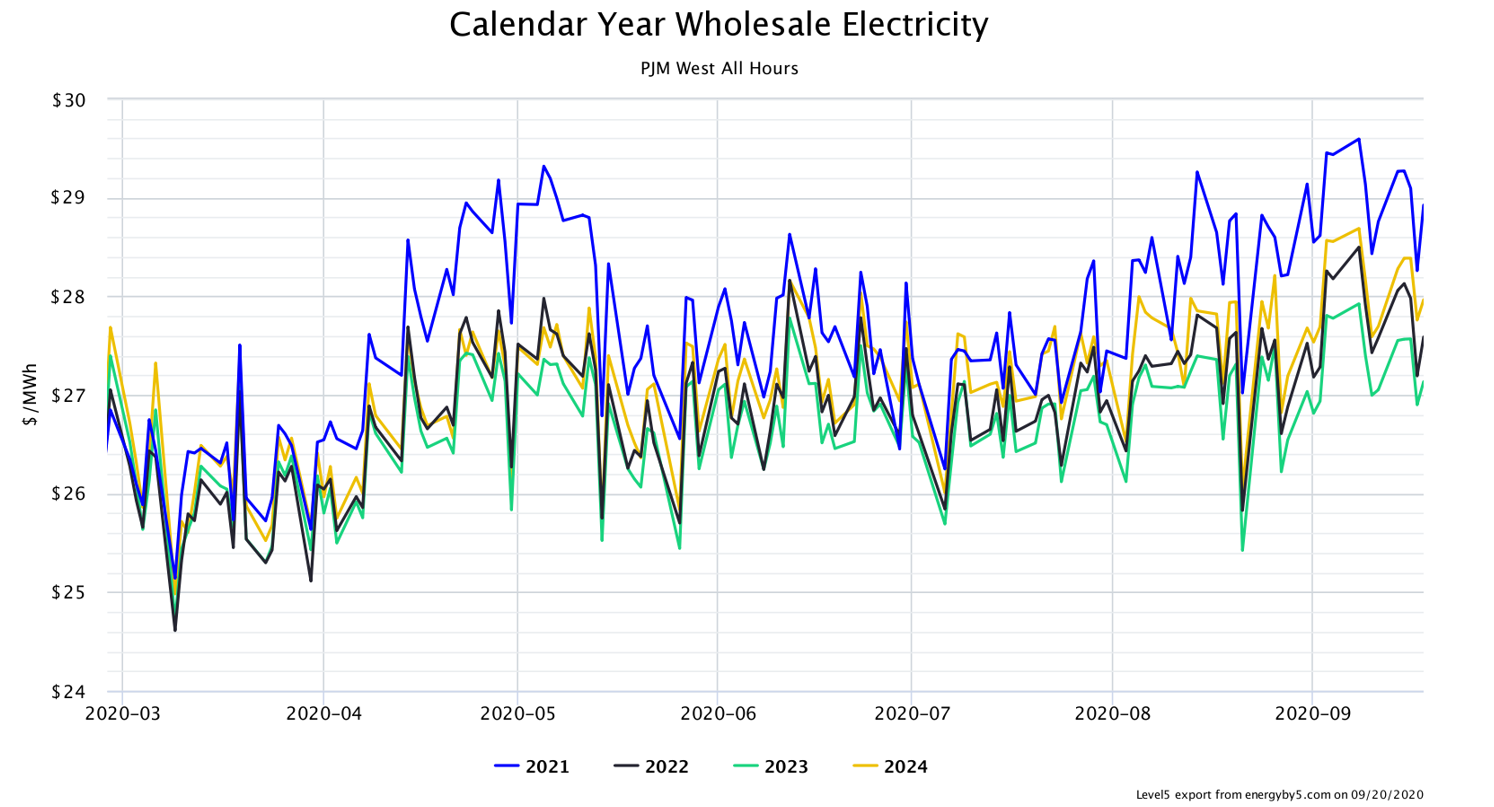

Figure 2 shows the same calendar year strips for wholesale electricity at the PJM West trading hub. Note how both electricity and natural gas prices were both near their lows prior to the coronavirus pandemic in early March. Natural gas and electricity prices rallied through May, then both began to soften through the middle of July before rallying once again over the last two months.

Figure 2: Calendar Year Wholesale Electricity PJM West, from 5

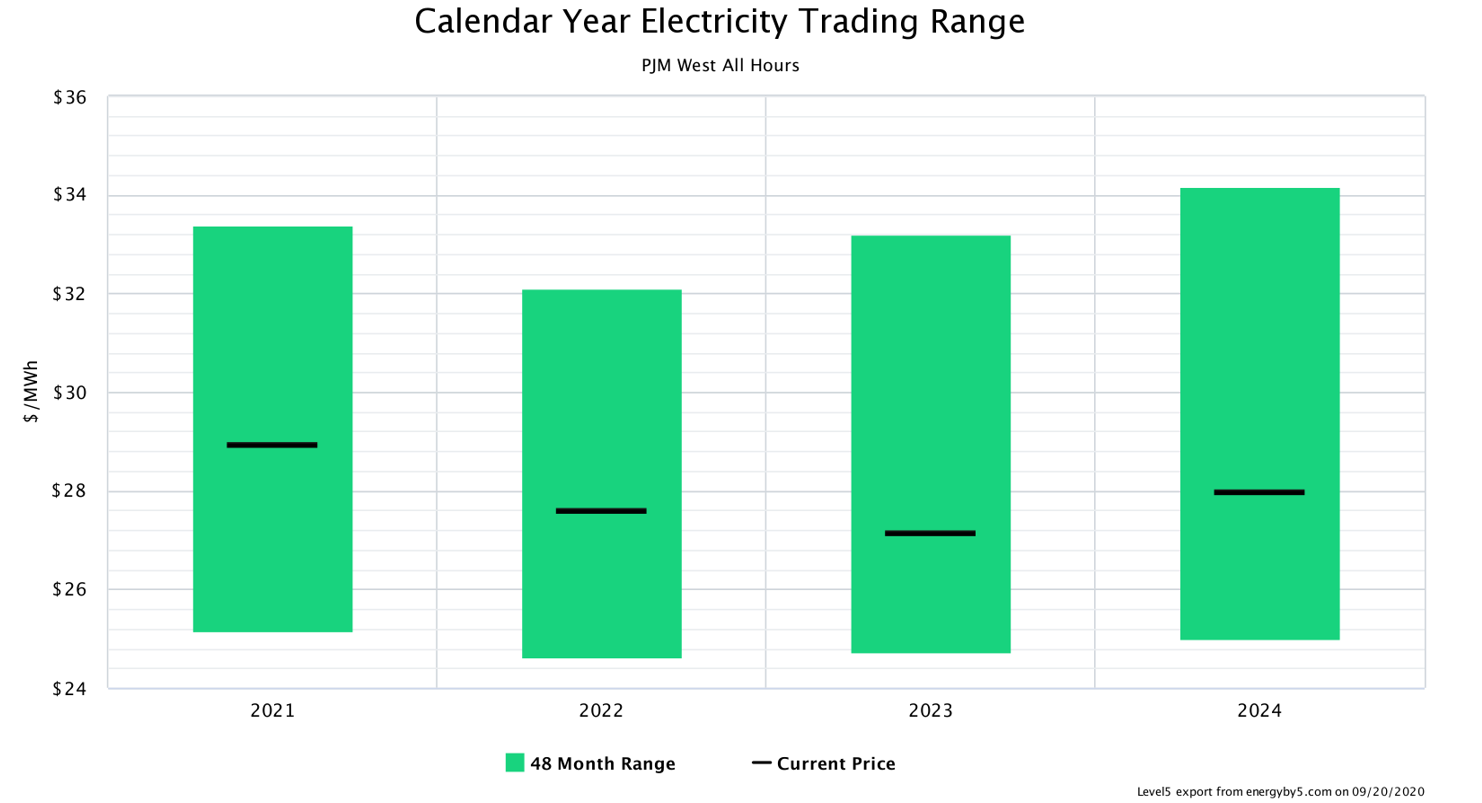

Figure 3 shows the 48-month forward trading range for wholesale electricity at the PJM West trading hub. The height of the green bar shows the range of low and high prices for electricity in calendar years 2021-2024. The black bar shows where electricity was trading on 9/21/20. There is a slight degree of backwardation (prices getting less expensive with time) through calendar year 2023 with a slight premium in 2024. With the exception of an increase in calendar year 2024, the NYMEX natural gas trading range chart shows an identical trend.

Figure 3: Calendar Year Electricity Trading Range PJM West, from 5

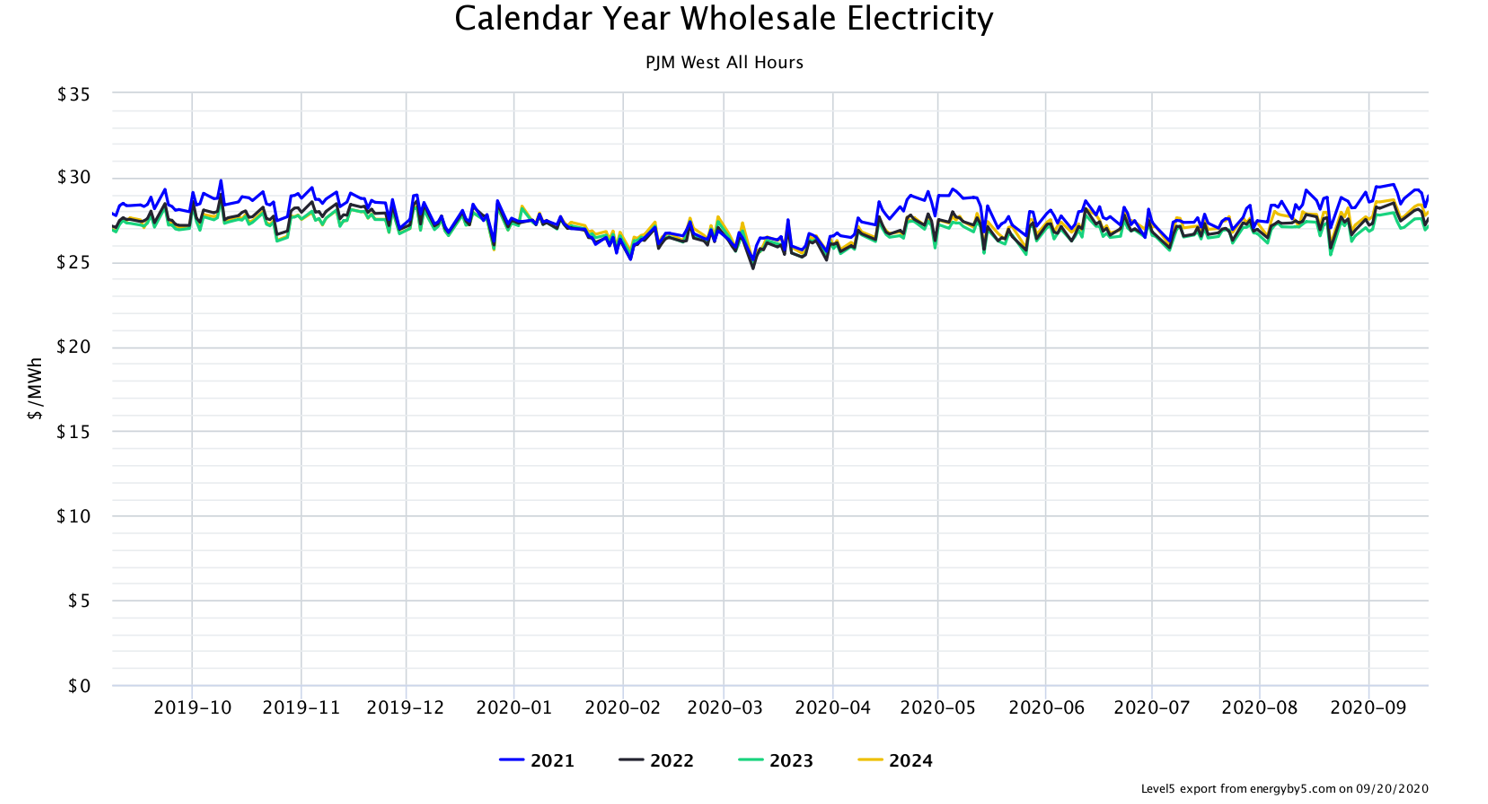

While there has been a strong rally in electricity prices in PJM, as shown in Figure 2, changing the scale of the y-axis shows that prices have been relatively flat over the last year. Figure 4 shows the same data depicted in Figure 2 with a different scale on that axis. This data shows that prices over the next four calendar years have traded within a range of $5/MWh, a trading band of less than 20%, and most of the time the commodity stayed within a 5% band around $27.50.

Figure 4: Calendar Year Wholesale Electricity PJM West, from 5

Clients with open electricity positions in PJM through 2025 should consider making electricity purchases now, given that the market is “flat” and trading near the bottom of its 4-year trading range. However, traditional fixed-price electricity products may not be the best option for many clients. To generate a fixed-price electricity offer, suppliers will examine historic electricity usage and the peak demand for each electricity account and use that data as the basis for their fixed price. In the wake of the demand destruction that has occurred during the coronavirus pandemic, historic electricity usage and peak demand data are not necessarily indicative of future electricity usage and demand. This article in our August 5x5 discusses why clients in PJM should consider other electricity product options.