The weather has been unusually warm this month, which has drastically pushed down natural gas prices. This stretch of higher temperatures in Texas and across the US has taken a lot of energy out of both the natural gas and electricity markets. It has also created very attractive opportunities for shorter-term purchases, since natural gas is the fuel for many for power plants across Texas. Moderate temperatures along with low spot price volatility from this summer have created weakness in future heat rates and also contributed to this electricity market correction.

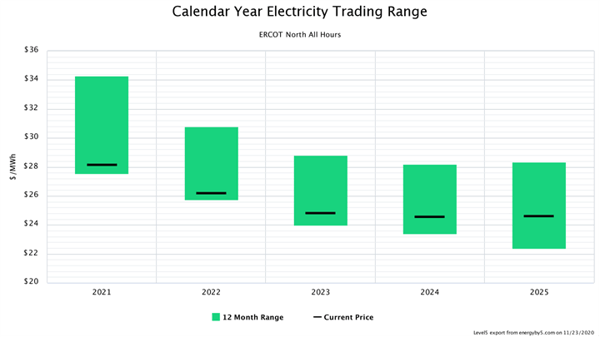

Figure 1 shows the 12-month forward wholesale trading range for electricity in the North Texas zone. The height of the green bar shows the 1-year range of low and high prices for in the calendar years on the x-axis. The black bar shows where prices are trading as of 11/23/20. For calendar year 2021, the wholesale price of power in the North Texas zone traded at a 12-month high in late September, at a price of approximately $34 per MWh. As of Friday, November 20th, that same strip was trading just above $28 per MWh, a drop of almost 17% or $6 per MWh. Figure 1 shows that wholesale electricity prices for calendar years 2021 to 2024 are at, or near, the bottom of the 12-month trading range.

Figure 1: Calendar Year Electricity Trading Range from 5

Figure 1: Calendar Year Electricity Trading Range from 5

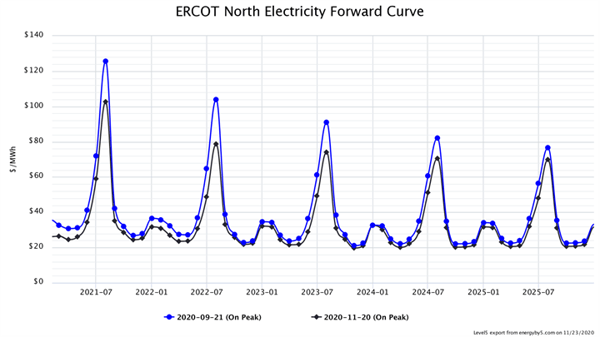

While the free-fall in natural gas prices has lowered the entire forward curve, the largest movements have been in the two summer months of July and August for 2021 through 2024. Figure 2 shows the forward curve for On-Peak electricity in the North Texas zone in late September (blue line) and on November 20th (black line). Note the significant drop in price for August electricity in 2021, 2022, 2023 and 2024. Given that retail prices for electricity in Texas are heavily influenced by the price of electricity in July and August, this recent correction will have a multiplying effect on retail offers.

Figure 2: ERCOT North Electricity Forward Curve from 5

Figure 2: ERCOT North Electricity Forward Curve from 5

This warm weather has created a very favorable purchasing opportunity for those with open electricity positions in Texas. However, a change in the temperature could quickly send this market in the other direction. There could be a rebound in the natural gas market as the days continue to get shorter and colder. In Texas, a rising natural gas market lifts all power prices. This recent electricity market correction could be an early Christmas present for those clients who need to make any electricity purchases between 2021 and 2025.